Archive

MARKET NOTES: US Equity markets stage a routine pullback from 38% retracement level

MARKET NOTES: US Equity markets stage a routine pullback from 38% retracement level

US Equity markets confirmed a correction by staging a minor pullback from the 38% retracement level on the main S&P 500 index. There was some extra excitement in the NASDAQ [QQQ proxy ETF] following an 8% rally in Microsoft welcoming Steve Ballmer’s retirement. The bear rally is unlikely to change the market direction in either NASDAQ or MSFT. It did give the bears a good scare though.

The Dollar’s preliminary moves after the low 80.90 are supportive of a like Dollar rally back to 85.50. We should see confirmation of that in the early part of next week. Until that happens, other currencies are likely to just mark time. In particular the EURUSD pair appears pretty undecided about where it wants to go.

Commodities were showing an upward bias on a number of charts. While the rallies in Gold & Silver are the usual counter-trend rallies one would expect in a bear markets, the trends in Copper and Crude suggest commodities may be bottoming out. For both Copper and Crude, I have had to revamp my wave counts to take into account the inherent bullishness.

Nearer home the panic in USDINR may have been overdone. Dollar rallied to a high of INR 65.50 which was my year end target for the pair. On more sober considerations, I think the market will settle down for some consolidation above 62 but below 65.50. A rally in DXY would impart an upwards bias to the Dollar in the Rupee market but much of the rally up to DXY 85 is already in the price.

NIFTY staged a routine pullback from 5250 level after a near panic liquidation. However, that didn’t look like the capitulation that the market needs. I expect the downtrend to resume in a more sedate fashion after a brief corrective rally.

There may not be an early end to world bearish trends. Look to exit rallies & hoard cash for better buys later.

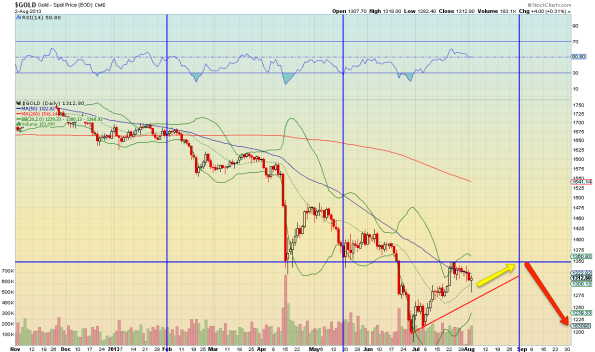

Gold:

Gold rallied to a high of $1385.58 as expected in this blog before closing the week at 1370.80. The bear rally in gold is not yet over and we could see gold rally higher $1425 before it corrects for the price rise from $1180. But that correction is probably two to three weeks away.

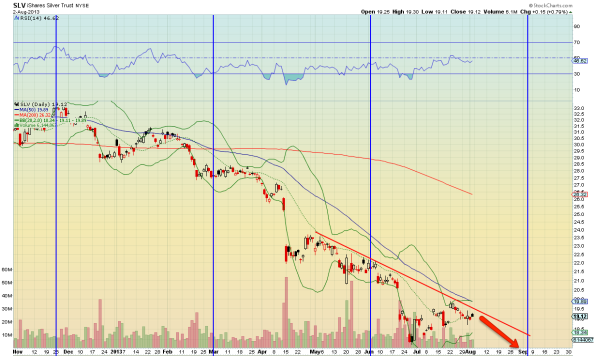

Silver:

Silver too has been in a counter-trend rally from the low of $18.17 and made a high of 23.60 before closing the week at $23.1660. The bear rally may not be done as yet & the metal has the potential to rally to $26 before it corrects for the price rise from $18.17. The metal continues to be bearish in the long term.

HG Copper:

Have had to completely revamp my read on Copper following its recent price behavior. I now think the bottom of 2.98 formed on 21st June was the start of a new bull run in the metal that may see it reach for 4.0 by end of 2014. First confirmation of my revised read on the metal will come when it breaks [and sustains] above its 200 DMA and major overhead resistance at 3.4250. That could happen over the next two weeks. Upon confirmation of 3.4250 as the new support, we could be confident that the metal is in a new bull rally. In any case, as suggested before, there is no case for continued bearishness in the metal.

WTI Crude:

As in the case of HG Copper, have completely revised my wave counts on Crude in line with recent price behavior and revert to a simpler wave count. I now think the low of $77.41 on 21st June 2012 marked the start of another bull rally crude which could see it head for the previous top of $148 by end of 2014. First confirmation of this scenario would come if WTI crude fails to breach support at $99 in the current correction. Crude bounced from its 50 DMA at $103.15 last Friday. Further confirmation would take time but follow when crude breaks atop $110 and sustains above it. My earlier scenario that called for a correction down to $92 before a significant rally is still possible but the probability of that has receded significantly following repeated bounces in the price from $103 area. Hard commodities in general are showing signs of reversing long term trends. Crude and Copper being industrial in use may be the first ones to confirm the reversal in trend.

US Dollar DXY:

DXY closed the week at 81.53, just under its 200 DMA in the 81.60 price area. I continue to think the low of 80.8950 on 8th August marked the base from which a new bull rally in DXY has begun. First confirmation of this scenario will come upon a break above 82 and when DXY observes the 200 DMA as the new support for DXY. I think this could happen as early as next week.

A sustained rally in the Dollar will certainly pressure commodities across the board. Given my read on Copper and WTI crude, it will be interesting to see if these two commodities hold to their rallies despite a surging Dollar.

EURUSD:

Not offering an opinion on EURUSD.

USDINR:

USDINR made a high of 65.56 during the week, which incidentally my target for the Dollar by the year end in Rupees. The Dollar closed the week at 64.55. My sense is that the Dollar has overshot its immediate target due to acute panic in the Rupee market and needs to consolidate for a while before its next move becomes apparent.

Expect the Dollar to consolidate below 65.50 and above 62 for the next 4 to 6 weeks. A lot will depend of the contour that DXY follows in the international markets. I think a DXY rally abroad up to 85 may already be factored into the USDINR although that would give the Dollar an upward bias in the Rupee market.

In any case, the worst for USDINR may have worked itself out of the system already.

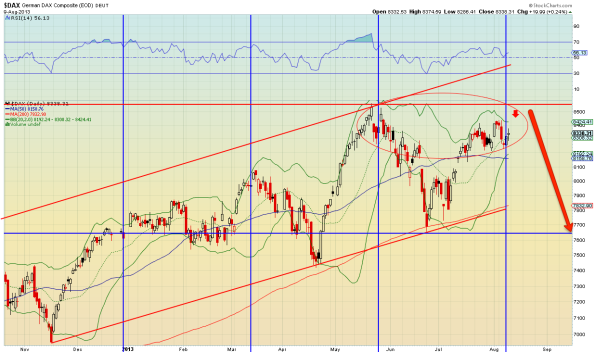

DAX:

DAX fell from 8438.12 to a low of 8300, just short of its 50 DMA and then corrected upwards to close the week at 8397.89. There is nothing on the charts that suggests that the downtrend in the index has reversed. I think the continues on its course to test 7650 support over the next few weeks barring normal pull backs of the sort we saw towards the end of last week.

NIKKEI 225:

Nikkei closed the week at 13365.17 and continued its orderly decent towards 12500 price area which is also where its 200 DMA is positioned. No change in the prognosis. Nikkei remains in an orderly correction to retest at least the 12500 price area.

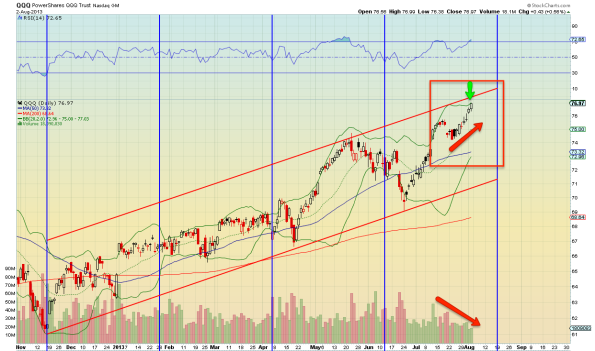

Nasdaq [QQQ]:

QQQ closed the week at $76.67 after making a low of 75 during the week. The pull-back in QQQ surprised because it filled the price gap at 76 in the charts indicating a surprising strength in the index. That the pull-back gained from an 8% rally in MSFT does not take away from the strength of the pull back.

That said, the index continues in its corrective trajectory towards 69.50. Only a decisive new high would negate the drift towards 69.50.

S&P 500 [SPY]:

SPY showed the true underlying trend in the US equity markets without being clouded by the bear rallies in FB, AAPL and MSFT. The share has dropped from 172.14 to the 38% retracement level before staging a modest pullback that may continue in the next week. The index remains on course to test 155 which is also is 200 DMA price area.

NSE NIFTY:

NIFTY continued to be in a downtrend. It closed the week at 5471.75 after making a low 5258 during the week under near panic conditions. However, the pullback from 5258 to 5458 is the usual corrective move for oversold conditions and nothing suggests that the downtrend has halted much less reversed.

The corrective pullback may continue for a few days but expect NIFTY to resume its downtrend to the 4800 price area by end of the next week. I would be surprised if the NIFTY does not test 4500/4800 before the current downtrend exhausts itself.

NB: These notes are just personal musings on the world market trends as a sort of reminder to me on what I thought of them at a particular point in time. They are not predictions and none should rely on them for any investment decisions.

MARKET NOTES: The correction is here.

MARKET NOTES: The correction is here.

NIFTY announced its intentions with a near crash though it wasn’t as severe as I expected. 5500 surprisingly wasn’t taken out although that is no reason to cheer. Nikkei has been correcting for long. The suspense was rserved for the US & EU markets. My reading of the charts shows both EU and US markets have finally tipped into a correction that might not be the usual one shot affair. See the NYSE Composite chart for more on that.

The currency markets were marking time for the Dollar to bottom. Chances are that DXY has indeed bottomed at 80.90 and is now sitting at the cusp of Wave V rally that will likely create new highs. Both EURUSD & USD JPY more or less confirmed the 80.90 bottom in DXY.

Metals staged a bear rally. Not unexpected given the new lows most commodities have made recently. It will be interesting to see how long these bear rallies sustain as DXY rallies and equities come off their highs. I suspect not for very long as people get risk averse.

Nearer home, RBI imposed a slew of capital controls curbing the demand for Dollars in the INR market. It was a self-defeating step except for the 10% import duty on gold which is legitimate from an equity point of view. RBI may have forestalled a move to the $INR = 70+ level with its controls but I suspect we will still see $INR at 62.50 to 65 range by year end.

This is the beginning of a correction which may not be the usual 1 leg affair. So wait to see how markets shape at the lows. Don’t catch falling knives.

Gold:

Gold closed the week $1371, but well below the congestion zone of $1380. The close also above the metal’s 50 DMA, which is currently in the 1300 price area. The metal could rally higher to the 200 DMA price area of $1500.

Very difficult to see the metal top $1500 in the near future. I would look to sell the metal again above $1500. Until then investors not already into the bear rally should avoid trading the metal. Trading bear rallies for the very short-term is a mug’s game.

Long-term, the metal appears pretty bearish.

Silver:

Silver closed the week at $23.20, surprising with a bear rally that knifed through its 50 DMA on the way up. Silver is in a counter-trend rally from its recent low, and while the sheer size of the rally looks impressive, the wave counts suggest new lows in the metal are not far off. The present spike can extend $26. However, the meta is likely to trend down by October end looking for new lows. Avoid trading the rally if not already in.

HG Copper:

Copper continued in its bear rally mode closing the week at 3.363 just a wee short of its 200 DMA in the 3.40 area. It will probably nick it next week, but as discussed last week, this is a bear rally and its is hard to see any decisive move beyond 3.45 at this stage. I would expect to see the metal to continue to trend sideways till the end of October. While a new low in Copper is unlikely below 2.95, the correction in the meta in terms of time isn’t over.

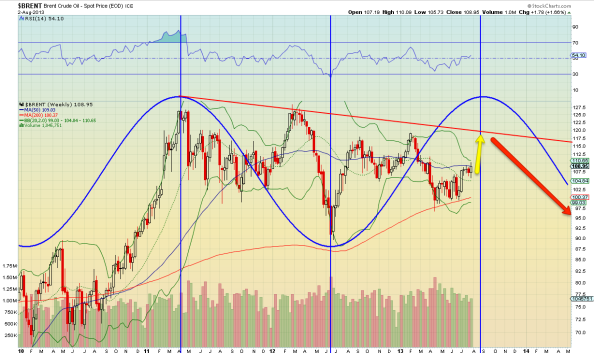

BRENT Oil:

Brent too continued in its counter-trend rally from the recent low of $98.95, closing the week at $110.40. The rally can extend to $117.50 over the next week or so. However, maintain my view that Brent will turn down back from $117 price area towards $98 and continue is a down trend there after for a long time.

Traders should look to establish shorts in this bear rally at higher levels.

US Dollar [DXY]:

The US Dollar is in the process of confirming a bottom at 80.90 or thereabouts before rallying back to its previous top. As a part of this process, DXY rallied from a low of 80.97 to 81.995 and then corrected down to a low of 81.06. The process of confirmation is complete and I expect a fairly sharp & robust rally in DXY from next week.

First target for DXY from current levels is 82 followed by 82.70 and possibly 83.21. Position traders can go long with a stop just under 80.50. This Dollar rally could be spectacular.

EURUSD:

EURUSD turned down from 1.3400 [the double top discussed last week] to make a low of 1.32050, just short of its 50 DMA and corrected upwards to close the week at 1.3329. Expect EURUSD to turndown again from here towards the 50 DMA. I expect the 50 DMA to give way towards the end of next week & EURUSD to then pause & correct from its 200 DMA.

EURUSD is more likely to be driven by DXY than its own steam. But expect the broad trend to be downward barring corrections.

USDJPY:

USDJPY closed the week at 97.52. The currency pair presents a pretty confusing picture on the charts. The Dollar has been correcting down against the Yen from the high of 103.56 and that correction continues to propel the $ down towards 94. On the other hand, the correction in DXY is very nearly over while USDJPY is still high up at 97.50 instead of the 94 that one would expect. The strength in the Yen is puzzling.

I expect USDJPY to reconfirm its recent bottom at 96.89 before moving up with DXY. No targets for the currency pair. Will avoid trading it until a clear trend is confirmed.

USDINR:

$INR closed the week at 61.65. Had expected some consolidation in the currency but apparently the panic is such that normal corrections are fleeting. I would expect the $INR to range between 60 to 62 over the next two weeks.

Maintain my target of 62.50 to 65 for $INR by year end. Note the charts, & my methods have, little validity for a reliable estimate given the trading & other restrictions imposed by RBI on $INR. So treat estimates with more than due caution.

DAX:

DAX closed the week at 8391.94. A few points may be noted. First the wave counts indicate the current leg of the rally ended on 14th August at a high of 8457.05. This high was lower than the high of 8557.56 recorded on 22nd May. These two facts, together with the large number of divergences in the charts & oscillators indicate DAX has turned down for an intermediate correction.

A lot will now depend on where DAX ends up in this leg down. The logical target should be 7650 which is well below the the Index’s 50 and 200 DMAs. If that support is decisively taken out, we will be in an intermediate correction spanning many months. Too early to give the leg down its own wave count. Time will tell. Don’t bet on second chance in this market.

NIKKEI 225:

NIKKEI was the first major market to turn down. There have been no surprises at all. The index closed the week at 13650.11 well below its 50 DMA. Note the 200 DMA is in the 12000 area while the previous low was 12435. I would expect Nikkei to at least test its 200 DMA rigorously in this leg of the down correction. So the index has a lot of downside. Not sure what that means for the Yen though.

Shanghai Composite:

Last week I mentioned the surprise that Shanghai hadn’t produced the expected spike above its 200 DMA. Well, the index produced one this week but it was just a spike with a small candle body. More likely traders telling other traders we know it should have been there and we will get back to it at a more opportune time. Be that as it may, there is no sign that the correction in the Chinese market is over. I suspect Shanghai will correct down with world markets to test 1850 again and may then rally into its 200 DMA before beginning the last major leg to its correction. Shanghai is into a decade long bear market if not more.

NASDAQ 100:

Decided not to bore you with a recap of how right I was about the US markets. You can go back last two posts to see for yourself if interested.

NASDAQ 100 turned down after making a high of 3149.24 on 13th August more or less on D-Day. And then it gapped down to close at 3073.91. NASDAQ typically is the most volatile of the major US indices. But it traces [with lead or lag] every move of SPY. So while its not clear from the above chart if Nasdaq 100 has tipped into an intermediate correction, an examination of the NYSE Composite Index and SPY given later do show that we could be into a fairly long intermediate correction. Not confirmed of course but the logical argument for it is very sound.

First major target for NASDAQ 100 from here is 2825 which is also its 200 DMA. So it should be fairly clear that the 200 DMA will decide the future course of the market.

NYSE Composite:

First point. NYA made a high of 9695.46 on 22nd May and a lower high of 9690.10 on 2nd August. In short, from the previous rally top in May, after a correction, the index failed to make a new high in the current rally. The index’s target on the downside, the low of the previous correction is 8820, and that’s well below the 200 DMA, a serious breach of which will trigger an exodus from long-term investors. Furthermore, the May high is below the 2007 high recorded by the index.

Now the powers-that-be can knock off duds from NASDAQ100 and S&P500 and replace them with new better performing stocks periodically. That legerdemain keeps the indices ticking along nicely. But you can’t pull that trick on a composite index like the NYA because it includes all the stocks on the NYSE. A stock would have to delist to exit. So NYA presents a truer, less “managed” picture of the market. And NYA says new highs on SPY yada yada notwithstanding, the aggregate of stocks on NYSE are in a multi-year bear market. In this leg up they barely reached the previous top. The main trend is down. Will the market reach below its previous low? Common sense says it will. Ergo we have an intermediate down-trend or a sideways market.

Keeping this larger picture in mind, now look at the exchange “managed” indices to decipher their next moves. To my mind both NASDAQ100 and SPY have already tipped into an intermediate correction subject to confirmation by a lower low. But then you need to know if you will have a lower low now & not when it is confirmed! The probability of a lower low is pretty good IMO. Hence the NYA chart here.

S&P500 [SPY]:

Note the contrast between SPY above and NYA in the previous chart. Deception, thy name is market.

So SPY did make a new high in the current rally but I take that with a small pinch of salt firstly, because my wave counts show this is the last rally possible before an intermediate correction, and secondly, because the top here isn’t confirmed by a similar top in NYA.

SPY closed the week at 165.83. The downside target for this rally is 154, which is the price area of the index’s 200 DMA. I pick that as the target because other indices show the markets long term trend represented by its 200 DMA is going to stressed before the market turns up if it has to. SPY’s previous low though was 156, not very far from 154.

The market will tell us if there is a second leg to the current correction in due course. Beware this isn’t likely to be 1 leg run-of-the-mill correction. So wait to see what happens at 154 before you buy back into the market.

NSE NIFTY:

NIFTY closed the week at 5507.85 after turning up briefly from its support at 5473. The index’s 50 DMA has just triggered a long term sell signal on the charts. So barring a minor scuffle at 5450, the index is more likely to cave below towards the 5300 price area where some support exists. However, given the correction in world markets, my sense is NIFTY will in all probability test 4500-4800 range rather rigorously in order to have a robust base for a future rally.

Not the time to catch falling knives. We are most likely towards the beginning of a correction in NIFTY, [in this leg] than towards the end of it.

NB: These notes are just personal musings on the world market trends as a sort of reminder to me on what I thought of them at a particular point in time. They are not predictions and none should rely on them for any investment decisions.

Guest Post by @SajaanoBanerjee: Strategy For Congress Revival in UP

Congress revival strategy in Uttar Pradesh

There are enough indications that the general elections to elect the 16th Lok Sabha will be held in the summer of 2014. India has seen fourteen prime ministers, of which Uttar Pradesh alone has provided eight of them. Uttar Pradesh has 75 districts and 80 Lok Sabha constituencies. It has a population of about 210 million and 120 million voters. Thus there is enough empirical evidence to suggest that the road to Delhi is via Lucknow. The chief minister of Gujarat who nurses prime ministerial ambitions has planted his trusted confidante Amit Shah as the prabhari (in charge) of the BJP in UP. Caste has trumped religion decisively especially in the post 1989 Mandal scenario.

Caste Structure in Uttar Pradesh (figures in percentages)

| Brahmins |

12 |

| Thakurs |

7 |

| Banias |

2 |

| Dalits* |

25 |

| Muslims |

18 |

| OBC** |

34 |

| Others |

2 |

*Dalits include Jatavs, Chamars, Koris, Pasis etc

** OBCs include Yadavs, Lodhs, Kushwahas, Kurmis, Mauryas etc

In this column, I argue that the Brahmins who have been in the political wilderness since 1989 needs to be aggressively wooed by the Congress party. The political revival of the Congress party in Uttar Pradesh rests primarily on getting the Brahmins back into their fold. Uttar Pradesh has not seen a Brahmin Chief Minister since ND Tiwari way back in 1989. The Congress Party has given at least 4 Brahmins as chief ministers in Uttar Pradesh.

Brahmins are faced with a political vacuum and looking up to a party that can give back their self confidence and dignity. However if the Congress party has a five year, forward looking strategy, the homecoming of the Brahmins is a near certainty. The Congress is the only party which has given Brahmin Chief Ministers.

Despite loud proclamations of championing the Brahmin cause, the BJP has never appointed a Brahmin Chief Minister in Uttar Pradesh – witness Rajnath Singh (Thakur), Ramprakash Gupta (Bania) and Kalyan Singh (Lodh, OBC). Both the SP and BSP are programmatically designed to not give the top posts in the party or government to anybody but Yadavs (in case of SP) and Chamars (in case of BSP). While both the BSP and SP are enticing the Brahmins, they can only share power and representation with these parties as king makers, but can never aspire to be kings. The BJP inspite of having a shrewd Thakur in Rajnath Singh as the national president of the BJP are getting the bulk of the Brahmin votes in successive elections. All this can change if the Congress can get its act together.

Why are Brahmins important in the poll calculus in Uttar Pradesh? Brahmins are 12% of UP’s population. Brahmins are facing a leadership vacuum in the state. They are looking for a leader/party that can capture their imagination and can safeguard and consolidate their interests. Apart from Muslims, Brahmins are another community who have powerful oratory skills and are opinion makers in the villages and cities of UP.

The current strategy of the Congress party in wooing OBC satraps like Beni Prasad Verma (Kurmis) is sure to backfire, as seen in the 2012 assembly elections. Narasimha Rao wrecked the Congress party when he frittered away two thirds of the Uttar Pradesh assembly seats in Uttar Pradesh in 1995. He ensured that the Dalits shifted their allegiance enmase to the BSP since then. Post the Babari Masjid demolition, Muslims have also left the party, briefly voting for it in 2009 to keep the BJP out of power.

The Congress was once considered the natural party of the Brahmins. There must be concerted efforts to win back their trust by reminding them of how their fortunes are intricately linked to the fortunes of the Congress party. In neighbouring Uttarakhand, the Congress had a choice of Harish Rawat (Thakur) to be made Chief Minister in 2002 and 2012. However on both occasions they chose ND Tiwari (2002) and Vijay Bahughuna (2012) – both are Brahmins. In Delhi another Brahmin, Sheila Dikshit has been the chief minister for nearly fifteen years.

The Congress must identify an astute Brahmin leader who can tour all the districts of Uttar Pradesh and get these political messages across to the Brahmins in carefully orchestrated Brahmin sammelans. The Congress must pursue this core and committed caste constituency, and the “plus votes” will follow. The original vote bank of the Congress has been a lethal combination of Brahmins, Dalits and Muslims. If Brahmins come back to the party, can Dalits (25%) and Muslims (18%) be far behind?

Get the Brahmins back, rejuvenate the party structure, and the Congress party will see the first signs of a revival in time for the 2017 elections. The people of Uttar Pradesh rejected the Congress in 2012 (in the absence of an organizational machinery in the state) because they were not seen as a credible alternative to the BSP. It is disappointing to see that the Congress scion has abandoned his constituency in Uttar Pradesh, post the electoral reverses in 2012. Rahul Gandhi must lead the charge and be the voice of the Brahmins in Uttar Pradesh. The Congress is bound to be rewarded politically.

MARKET NOTES: A few points for India’s new RBI Governor

MARKET NOTES: A few points for India’s new RBI Governor

India’s new Central Banking Chief, Raghuram Rajan, is no stranger to markets in India and abroad. In fact he was one among those who warned of the banking excesses back in 2007 and what they implied for the credit cycle. So what I say will not be new to him. Nevertheless worth listing out a few things in the Indian context.

- A rally in Dollar is now widely anticipated. Whether it goes from DXY 80 to 85.50 or 89, the change in valuation of other asset prices will be huge. All world currencies will be impacted. $INR has to some extent ANTICIPATED the rally in DXY and wisely so. But an extension to the DXY rally from 85.50 to 89 will be devastating. That has huge implications for India’s exchange rate management. We need to use the crisis to put our exporters on a sound footing. This is not the time for short-term fixes no matter how tempting they are. Let the INR find a sustainable level that keeps potential exporters afloat.

- The surge in the value of the Dollar comes amidst an interest rate cycle that is turning up. That means there will be PE compression across the board in every asset class be it equities or commodities. India has foolishly kept interest rates too high fighting a structural inflationary rise in food prices that were below world prices with high interest rates. That foolishness has tanked the economy & choked banking. At some time the RBI will have to ease interest rates in INR markets against the world trend. That means $INR must account for that fact before hand.

- Tanking equity markets across the world will put unprecedented pressure on equity prices at home. The mess in the coal sector and power sector has clogged banks in cross-defaults. Growth will tank further unless government sorts out the mess in jinxed coal mine privatization & stalled power plants. Unrelated businesses must be insulated from cross-defaults for sometime. Pick up in growth will not be automatic since the fall is not cyclical but also structural. RBI must highlight steps under an “emergency plan” that need to be taken immediately, election or not. There is time.

- FII flows will not dry up if we let markets function normally. We shouldn’t worry too much about the losses forced on FIIs. They understand the inherent risk in equity very well. Let the markets function and weed out those who don’t add value. That is a bit counter-intuitive to lay folks but absolutely essential to attract new money into the market. Industrials who weep over the high cost of Dollar should be told to earn some.

- Don’t curb any import except Gold, that too strictly through punitive duties with a built in 12 month sunset clause. Make the sunset clause credible & builtin so that smugglers don’t invest in beating the system.

Last but not the least, even if NIFTY tanks to 4800, it is not the end of the world. As usual there will be a wall of cash waiting to invest at the right price provided we get the reforms back on rails. If FIIs have lost, their gain loss was a gain elsewhere. So there is no dearth of cash for investment in the system as such. It was RBI who destroyed our $Job economy. It is for RBI to resurrected it by instituting news ways of managing the INR. China is a good place to learn the art from. And yes, get labor reforms through.

Gold:

Gold closed the week at $1312.20, more or less on, but just under its, 50 DMA. Gold is in the process of confirming its near term bottom at $1179.40 made on 28th June. The metal could move down towards the $1200 price area over the next few weeks. However, the metal is also building a base for the counter-trend rally to follow. So the price will be a tussle between these two underlying trends till the middle of September or so. All told, the metal is now a buy at dips, especially in any crash in risk assets, for a tradable rally to the $1550 price area.

The longterm trend however continues to be bearish.

Silver:

Silver closed the week at $20.4070, a notch above the metal’s 50 DMA. Silver like Gold, appears to be in the process retesting the low of $18.17 as the new near-term bottom. With the close above 50 DMA, the probability of a dip to $14 now recedes. Silver too will fall in tandem with other risk assets and I would not take $18.17 as a “confirmed” bottom. However the next low by middle of September would be the base from which a decent tradable rally in Silver ensues.

No change in the long term trend which continues to be bearish.

HG Copper:

HG Copper spiked to a high of 3.3175, higher than its 50 DMA at 3.16 but below the 200 DMA now positioned just under 3.40. The spike came on higher than usual volumes. My sense is that the spike was just a one-off bear squeeze and there is no change in the underlying bearish trend. One would have to revise that view id the metal breaks above 3.40.

However, barring a fallback to 3.20 to test it as the new support, the short-term trend in the metal is bullish. The metal will most likely reconfirm 3.0 as the new support zone along with other risk assets before moving on. That said, it is the strongest metal on the charts. Anything below 3.20 may be worth accumulating for the long-term.

Brent Oil:

Brent closed the week at $104.87 after bouncing off its 200 DMA [positioned at $100] over the previous weeks. Brent could rally to $112 early next week but the commodity is all set to retest $100 or even lower over the next few weeks along with other risk assets. I would not bet on the rally’s base trend line holding up either. That said, Brent in unlikely to do anything below $90 and would be a screaming buy in any general commodity price crash.

US Dollar [DXY]:

The Dollar Index [DXY] closed the week at 81.17 after making a low of 80.89 during the week. As mentioned in earlier columns, DXY is in the process of confirming a near term bottom in the 80-81 price area before moving into a Wave V rally that could target 85.50 [at least] or even higher.

I suspect the process of confirming is all but over & will most likely be completed next week. The following Dollar rally could be explosive.

EURUSD:

EURUSD has been in a counter-trend rally to test the overhead resistance at 1.34 before heading down again to 1.27 over the next 2/3 months. What we see on the charts is a potential double top at 1.34 that is also reflected in the RSI and Stochastics. The currency pair closed the week 1.33442 after making a high of 1.34 during the week. Barring a possible pull back to 1.34 or even slightly higher, I sense the pair will turn down to head towards 1.27 region over next 2 months. First target for the pair lies at 1.32 which is its 50 DMA price area.

USDJPY:

The Dollar broke through the 50 DMA line against the Yen to close the week at 96.20. The Dollar is looking pretty weak against the Yen at the moment and could retest 94 early next week. But as mentioned with regard to the Dollar Index, DXY is in the process of testing a Wave IV bottom close to 80 and in the process the Yen appears very strong. While a trip down to 94 and the 200 DMA is not ruled out early next week, my sense is that the Dollar can launch into an explosive rally any time next weak and so shorts in USDJPY are inadvisable. Expect enhanced volatility in the pair going ahead. I would look to play long Dollar at the pair’s lows.

INRUSD:

For a broad perspective on the value of the INR [in USD expressed as cents] I examine the reciprocal of the USDINR chart with weekly prices to see how weak the INR is and to get a sense of where it could go.

INR started it current bout of devaluation/adjustment in July 2011, when its value was 2.3 cents. Yes that’s our INR. Was 2.3 cents; currently is about 1.6 cents. Taking the simplest model, the first Wave A of the adjust took the INR down from 2.3 cents to 1.7 cents. That’s a depreciation of 0.6 cents or a 26% devaluation from the value in July 2011.

In the normal course, one expect the corrective rally B from 0.17 in June 2012 to rally at least to 2.1 cents in April 2013 as shown by the Yellow corrective arrow. The corrective rally got nowhere near that target and grossly under-performed managing to get to just 1.9 cents. To me that is one very important measure of the structural weakness inherent in the INR.

We are in Wave C. How far can that take the INR? Note Wave A took the INR down 0.6 cents. We would expect Wave C to be usually as destructive as Wave A though it can be much more than that. 0.6 cents down from 2.1 cents [the point to which INR “should” have rallied] is 0.15 cents which translates into a USDINR rate of 66.667 to the Dollar. But if you take the “revealed weakness” in Wave B into account, the INR falls from 19 cents to 13 cents giving an $INR rate of 76!

Note these are gross approximations to reality; not reality. So we would expect Wave C to terminate somewhere between the $INR 66 to 75 mark. That sort of correlates to the anticipated move up in DXY from 80/81 level to 85.50 that I think will unfold in the next 2 to 3 months abroad. Note also that every other currency is will take a battering against the Dollar. It is not just the INR.

Raghuram Rajan, the new RBI Governor should clean out the Augean Stables, sort out the mess in exchange management, and start with a clean slate. Artificially propping the INR with stiff short-term interest rates hikes and trading curbs is the short road to disaster. The storms brewing abroad are beyond the control of Central Banks. The wise will profit, others will go down the tube. Export or perish, should be his blunt answer to MoF and Industry. Don’t curb any other import except Gold, that too strictly through punitive duties with a built in 12 month sunset clause. Make the sunset clause credible & builtin so that smugglers don’t invest in beating the system.

DAX:

I have bad news for DAX bulls. The index closed the week at 8338.31, well below the highest point hit during the week. Far more importantly, the index failed to rise to 8542.92, the high of the last rally. That means the index tips into a correction starting next week with a target of 7650.

We now have to wait and see far down the index will correct. If this move takes the ensuing move takes the index below 7650, we are into the much anticipated intermediate correction already.

There is a small probability of the index pulling a surprise and making a dash for 8550. Use to exit if not done already. The dash will not change anything much. We are headed for the 7650 area in any case.

Shanghai Composite:

Shanghai Composite closed the week at 2052.24 below it 50 DMA. That was a huge surprise because the minimum one would expect from such a battered down index at this late stage in the bear market is to at least spike up to its 200 DMA 2170 price area. It could still do that but it is probably too late for that.

What the failure to to rally to 200 DMA implies is that Shanghai too would follow the world indices into another correction which will probably test the low 1850. That then could be the trigger for an intermediate counter trend rally within a bear market.

NASDAQ 100 [QQQ]:

QQQ [a traded proxy for NASDAQ 100] 76.49. Nothing on the chart says it will not go on to make a new high during the course of next week. It probably will. But the advances are coming from poor breadth, poor volumes and from suspect sources. For instance, main line technology counters such as IBM are already in decline while stocks such as Apple propel the index via counter-trend rally within a long bear trend. Those are warning signs of an impending correction if not worse.

Note the failure in Shanghai and DAX, two of the major overseas markets have in all probability already slipped into a correction. So be warned. A big move down to 68.90 on QQQ awaits. And that is the minimum target. If the rally from there disappoints or if the market overshoots it, we are headed down for a long while.

S&P 500 [SPY]:

A new high on SPY, albeit not very far from 171, can’t be ruled out. Its value to bulls will be rather symbolic. And then a correction down to 156 or thereabouts should follow. If the market overshoots 156, we have an intermediate correction. If it falls short, the bull market remains intact. There is no way to tell apriori what will be the outcome. Volume, breadth, stocks in the indices, declining number of new highs all point to an intermediate top but time alone will tell.

NSE NIFTY:

NIFTY continued it correction by knifing through one support after the other. Even the long-term trend line support in place sine 2003 was taken out and that has major implications for the NIFTY.

The above is a weekly chart of the NIFTY to put the current correction in perspective. If my wave counts are true, [these are counts that have worked well so far] we are into the last stages of a correction for stocks that peaked in November 2010 [ not January 2008] and these stocks comprise such things as private & public sector banks, finance companies, consumer staples, technology etc that make up some 50 to 60% of the NIFTY’s market capitalization. The chart makes it clear we are in the initial stages of a giant C wave [this is a weekly chart] whose target would well be to retest 4800. That’s huge bear move ahead.

Note the move is coordinated not only with Emerging Markets but also the world’s leading equity markets. So the compression in PEs will compound the problems from a fall in value caused by declining profits. Worse, both will happen in the context of a tightening money markets world wide amidst an interest rate cycle that is turning up. Not to mention a general election that for once is questioning fundamental assumptions. I doubt if India has seen such a correction in its history before.

Be warned.

NB: These notes are just personal musings on the world market trends as a sort of reminder to me on what I thought of them at a particular point in time. They are not predictions and none should rely on them for any investment decisions.

MARKET NOTES: The US Dollar could surprise with a massive rally.

MARKET NOTES: The US Dollar could surprise with a massive rally.

Commodity markets having been marking time waiting for the equity markets to complete their rallies before they make up their minds. The currency markets are clearly anticipating a market sell off in equities that sends Dollars racing back to the safe harbor of US Treasuries. If the scenario comes about, a huge robust Dollar rally will force every other markets to find its new level in relation to it. That also means commodity markets will finally show us their final support. Those sitting on cash will have ample opportunity to stock on the best goodies. So don’t be afraid of cash no matter what pundits tell you about negative real interest rates.

A surging Dollar will put extraordinary pressure on RBI and the INR. RBI may be prepared to battle on till DXY gets to 85 but I suspect the true target is 89. Not sure what RBI’s reaction to $-INR at 70 will be. RBI had ample warnings of the fiscal & CAD deterioration. It had also ample warning about INR being over-valued. Instead of actively making markets & guiding them higher or lower to effect smooth change it slept and then woke up in a panic. RBI must understand markets are always made, they do not just happen. If RBI will not do it some other foreign bank cartel will. The only difference is that the cartel works for its own profit and RBI loses control over the market. So please learn to make markets; and money. The days of central banking by administrative fiat are over. Dead. Gone.

NIFTY is delicately poised on the neckline of a large inverted S-H-S with a target of 5000 from the neckline of 5600. That’s the good news. The bad news is that there is no rule which says the fall will stop at the target. All it says is a bounce then results. There could a short bounce before the neckline is breached to the 200 DMA area. But in all other respects NIFTY has decided not to wait for world markets to tank.

Hoard cash. There will be plenty of time & opportunity at far lower level than these.

Gold:

Gold turned down from the overhead resistance at $1350 and closed the week $1310.50. Gold hasn’t retested its new support at $1170. Furthermore, wave counts favor a retest of the 1150 price zone before a tradable rally ensues. My sense is that, barring minor pull-backs from time to time, Gold will drift towards $1150 by the middle of September.

That should give RBI some breathing time in managing gold flows into India.

Silver:

Silver pulled back on Friday from a low of $19.185 to close the week at $19.912. As discussed last week, Silver is yet to find a credible area of support and my sense is that it will hit the $17 area by end of August. I don’t think that would be the end of Silver’s bear market though we may get a rally of sorts from that area.

HG Copper:

As expected Copper continued to consolidate within a trading range above its recent low of 2.98 and the overhead resistance at 3.20. There may be a change of bias over the next few weeks from up to down but expect Copper to tread in the same trading range for some time more.

Brent:

Switching over from tracking WTI to Brent from this week. Of the two, Brent provides a clearer picture of the international price movements without getting overwhelmed by temporary pipeline logistics in the US domestic market.

The basic wave counts haven’t changed because of the switchover though quite a few the “anomalies” in prices have got ironed out. Brent, as WTI Crude, is in counter-trend rally from the low formed in June 2012 and that cycle appears to be coming to an end in August. The extent of the next leg down will tell us if the correction in crude prices is over or there is some more consolidation ahead.

Brent could shoot for $120 over the first two weeks of August before turning down for a correction. The structure & extent of the next correction will tell us where Brent is headed over the medium term. Exit at rallies.

US Dollar [DXY]:

DXY closed the week 81.978 after bouncing off its 200 DMA at 81.59. The correction in the DXY from the top of 85 is almost over barring a retest of 81.50 before the next rally back to the 85 region and possibly beyond that.

This blog being all about technicals, I won’t venture into discussing the expected correction in equities, the consequent sell off and search for yields in the US bond markets. But one thing is clear. A positive real yield in bonds, backed by some GDP growth, is available only in the US and that’s gonna make inflows in Dollar assets a given.

A resurgent Dollar will rip thru commodity markets, and equities of course. Nothing will be left untouched. So the question is will the rally extend beyond 85? My sense is yes given the extent of correction we saw in wave 4 that is just ending. Humongous volatility ahead.

EURUSD:

The EURUSD rally from the recent bottom of 1.27540 was completed at 1.3300 and we may be headed back to retest of 1.27 by end of September.

The pair closed the week 1.32810. The decent to 1.27 will be paced by the DXY and the extent of sell off that we see in Europe. Likely to be a very volatile trip down with vicious counter-trend rallies.

USDJPY:

USDJPY closed the week at 98.93. Having made a low of 97.67 the pair is now headed up with a first target of 101.50 followed by another overhead resistance of 103.65. My sense is the pair will follow DXY up over the next two months.

USDINR:

The $-INR corrected down from the top of 61.21 as expected towards the INR 59 area making a low of 58.68 during the week. The pair’s 50 DMA is at 58.65. Bouncing of the 50 DMA the pair was back to 61 in double quick time closing the week at 61.09.

We could have another leg of a correction down to 59 area from 61 over the next few days but the major trend remains up and a target of 62.50 looks close at hand.

$-INR cannot remain immune to the strengthening the overseas Dollar where I expect the DXY to rally from 81 to 85 [an up move of 5%]. That makes for a $-INR of 64 just [based on a buy in Singapore & sell in Mumbai model.] Of course reality is much more complex and some of the move from 81 to 85 is already in the price. Even so expect an correction to be short & fleeting while the $ trends up to test new highs.

RBI’s real problems will begin if the US equity markets tip into a deeper correction than 10% and the DXY shoots beyond 85 to 87 or even 89. The 87-89 is not ruled out. If you remember I had set my target for DXY for this full rally from 72 ay 89. And that appears well within reach.

RBI’s trading restrictions may help it manage the politics but the consequences for its credibility as a Central Banker are not worth contemplating. RBI was sleeping at the helm.

German DAX:

No surprises from the index. It is proceeding in a very orderly fashion towards its target of 8545 which it should hit by Friday, next week. The probability of a substantially higher high than 8550 is rather slim though always there. But it is unlikely to be so high that it rules out an intermediate correction as explained before. Execute exit plans and wait for the next correction to unfold & set direction.

NIKKEI 225:

Nikkei bounced up from its 50 DMA in the 13500 area and closed the week at 14466.16. The bounce is unlikely to last though it could stretch upwards 15500 as Nikkei plays catch up to the rally in US markets for the next week.

To my mind, Nikkei remains in a downtrend from the top of 16000 and the downside target, in tandem with other world markets, could be well below 11500. So the next rally in Nikkei is best watched from the sidelines.

NASDAQ thru QQQ:

QQQ [Techs in Nasdaq] pulled no surprises and proceeded in a an orderly fashion to to the target zone of $78. The uptrend has another week or 10 days to exhaust itself. The possibility of an overshoot beyond $78 exists but many key technology stocks are already into an intermediate correction following below expectation results. So yes, we could overshoot but not by much.

And if QQQ just meets target or marginally higher the probability of the following correction being deep enough to tip the market into an intermediate correction is very high. Exit and move to the sidelines. Avoid shorts till we are close to 16th August or we clearly have a top in place.

S&P 500 or SPY:

Like QQQ, SPY showed no surprises moving towards its target in an orderly fashion. Price versus volume divergences on both QQQ and SPY are pronounced but something you would expect at an impending top. SPY has a target of 175. It closed the week at 170.95. Clearly a long way to go with about 2 weeks to get there. The index is not even very overbought at this point.

Could SPY at $175 or better obviate the need for a longer term intermediate correction? It is a close call. SPY tanked from a high of 165.55 in the last correction to a low of 156 or 9.55 points. On the other hand, it has added only 4 points to the top of the previous rally and could add another 5 before it pauses for a correction. So we have 9 down – 9 up. Too close to call at this point.

Shorts not advised at this point but overall exist all long positions before 16th of August and wait patiently for a correction to sort out the market direction.

NSE NIFTY:

NIFTY was the real surprise of the week. First, it failed to make for the top of its trading range at 6240, stopping well short of it at 6065. Next on the way down, it took out both its 50 and 200 DMAs without a pause. Lastly the 3 recent tops at 6075, 6200 and 6075 look like inverted S-H-S with a neckline 5650. The Index itself closed the week at 5677.90 more or less at the neckline. That’s a pretty unusual run of events and the prognosis can’t be encouraging for bulls.

In the normal course, I would expect a respectable pullback from the neckline at 5650 to the 200 DMA before taking another shy at the neckline. I don’t think the neckline will hold for long and that gives the NIFTY a target of 5000. That would also more or less complete the correction in NIFTY in tandem with the world markets. Of course the process will take time.

NB: These notes are just personal musings on the world market trends as a sort of reminder to me on what I thought of them at a particular point in time. They are not predictions and none should rely on them for any investment decisions.