Archive

MARKET NOTES: WORLD EQUITY MARKETS 19.01.2014

MARKET NOTES: WORLD EQUITY MARKETS 19.01.2014

World Equity markets continue to exude cheer reflecting modest growth in the global economy accompanied by fairly lose and benign monetary conditions. Shanghai is an exception as authorities grapple with the problem of excessive speculation in asset prices financed via the Dollar carry trade. It is not a bubble that lends itself to easy resolution.

Back in India, NIFTY continues to climb a wall of worry as general elections loom, fiscal deficit surges and the current account deficit is barely under control following subdued gold & crude prices. This largely reflects the fact that much of the negativity was already in the price. All said & done, Indian GDP continues to grow at 5% plus rate and a financial bankruptcy on the external account is a still remote event.

Under the hood, there is considerable churn in stock in the US & European markets. Should the interest rate curve start sloping upwards reflecting normal real growth, the financials will stand to make a lot of money and their valuations are pretty cheap given the bad patch they have had since the year 2000. Look for values in this sector for further impetus to S&P 500.

Happy trading.

S&P 500:

Some people have asked for analysis focused on the near-term. So presenting the hourly chart in $SPY above.

To my mind, the drop from 184.75 on 31st December to 181.25 on 14th January corrected the run up from 177 to 184.75. $SPY has since rallied to high of 184.85 and is now correcting for that run up. I would be greatly surprised if the bulls yielded the gap just below 183.50 to the bears in this correction. Following the gap there is much more robust support at 183.

I would expect $SPY to resume its rally in the next to 184.25 and beyond. There is really nothing bearish on the charts so on the charts as long as 181 level holds.

Nasdaq 100:

The near term picture for the Nasdaq 100 [$NDX] is similar to that of $SPY.

In my view, the drop from 3591.25 to 3500 corrected the run up from 3430 to 3591.25. $NDX then went on to make a new high of 3610 and is currently correcting for that run up. First support lies at 3580, which held up on first test on 17th January. More support exists at 3570 followed by that at 3540.

My sense is that the gap between 3580 and 3590 will not be filled here and the index is likely to rally sharply to new highs beyond 3617. Position traders may like to keep their stops just below 3520.

Nothing remotely bearish on the index as such but under the hood tech stocks are showing some signs of exhaustion. On the other hand financials are likely at the beginning of a fresh surge up. So do take a look at what you hold than just the index.

NIKKEI 225:

Nikkei is in a very strong uptrend with first target of 16,700. I think the Index intends to clear the previous high of 18,260 in the next 12 to 18 months. That said, 16.700 would be a fairly formidable overhead resistance.

Nikkei made a high of 16320.22 on 12/30/2013 and has been correcting since then. Its 50 DMA is currently at 15,368, which should act a support and has been tested successful once. Further support lies at 15150 followed by a more robust floor at 14800. My sense is that 15350 floor is unlikely to be taken out in this correction.

On the other hand I see a high probability that Nikkei may stage a very sharp rally to just under 16,700 and correct from there in a fairly complex move. The next few weeks are for consolidation. But my sense is that consolidation will happen in a higher trading range of 15,800 to 16,700 rather than the current one. Nothing bearish about the Index.

DAX:

$DAX is in a strong uptrend that will see very brief though sharp corrections over the next two weeks. The Index is targeting 10,000 plus before the end of May.

There will be a bit of consolidation before the index makes a bid for 10,000 and my sense is that having seen a sharp running correction from 2nd December to 14th January, the index is more likely to spike up to just under 10,000 early next week and then consolidate a bit above 9700 for a week or two before making another attempt at the target.

Day to day plays isn’t my forte. Simply don’t have access to the kind of data necessary for a proper analysis of the technical play. So take the above with a bit of caution. However, I am pretty much confident that [a] 10,000 will be taken out much before May and [b] it won’t be taken out at first or second attempt.

Position traders should hold with a stop under 9700. There is nothing bearish in the index yet. And all indications are for an early take down of 10,000.

Shanghai Composite:

Among the major world equity markets Shanghai continues to be the most unambiguously bearish. The Shanghai Composite Index appears headed for a retest of its major floor at 1660 by end of May. There may be minor corrections on the way but the direction is clear enough.

The other noteworthy technical event is the generation of a clear sell signal so late in the bear market with the 50 DMA moving well below the 200 DMA. I wonder what the market knows what we don’t. Avoid calling a bottom on this one. Wait for clear capitulation. In the near term the index is clearly oversold and could pause a bit. But the respite won’t last long. Make a buy list but wait for capitulation.

NSE NIFTY:

NSE NIFTY appears to be climbing a wall of worry what with the Indian economy being ringed with huge fundamental problems at the macro level. But then markets have been so hammered in recent years 6 years of a bear market that I for one wouldn’t question the market’s wisdom. This blog is just about technicals and the message from them is one of cheer. The markets are headed up though only they know why!

The NIFTY made a technical low of 5118.85 on 8/28/2014 and in many ways it can be said to have marked the end of the bear market that began with the crash of January 2008.

The NIFTY has been in uptrend since then making a high of 6342.95 on 11/03/2013. It went into a sideways correction since then and to my way of reckoning, the correction to the run up from 8/28/2013 to 11/03/2013 ended 1/08/2014 at the low of 6160.35, making for a fairy shallow correction to the indices.

Since then the Index has rallied to high of 6346.50 and has fallen back a bit from there. The correction is minor and to be expected as the index can be expected to take 3 or 4 attempts to break free to new all time highs. My sense is that we could well see NIFTY at 6600 by the end of May or just before India goes into polls for a new government.

Nothing bearish in the NIFTY as far as technicals go. I would keep a sharp stop loss at 6100.

BSE Small Caps:

The BSE Small Caps Index [BSCI] made a low of 5100 on 8/28/2013 and rallied from there to a high of 6145 on 11/08/2013. It went into a running correction from that point but continued upwards and it is possible that the running correction ended 1/17/2014 although the possibility of another test of the 50 DMA at 6270 in the next 10 days should not be ruled out.

The index’s 50 DMA crossed over above the 200 DMA on 12/03/2013. Currently the Index is at 6476.76, well above the 50 DMA as well as the 200 DMA at 5851.25.

The Index Price ROC is in oversold territory. I expect the index to head for highs beyond the 6750 level. The steepness of the rally is largely owed to the way stocks were hammered on the way down. Having said that, there is nothing bearish on the charts. I would expect a clear breakout of the small cap index above 7700 by May end or before elections.

Stay with liquid stocks when dabbling in small caps.

MARKET NOTES: A few points for India’s new RBI Governor

MARKET NOTES: A few points for India’s new RBI Governor

India’s new Central Banking Chief, Raghuram Rajan, is no stranger to markets in India and abroad. In fact he was one among those who warned of the banking excesses back in 2007 and what they implied for the credit cycle. So what I say will not be new to him. Nevertheless worth listing out a few things in the Indian context.

- A rally in Dollar is now widely anticipated. Whether it goes from DXY 80 to 85.50 or 89, the change in valuation of other asset prices will be huge. All world currencies will be impacted. $INR has to some extent ANTICIPATED the rally in DXY and wisely so. But an extension to the DXY rally from 85.50 to 89 will be devastating. That has huge implications for India’s exchange rate management. We need to use the crisis to put our exporters on a sound footing. This is not the time for short-term fixes no matter how tempting they are. Let the INR find a sustainable level that keeps potential exporters afloat.

- The surge in the value of the Dollar comes amidst an interest rate cycle that is turning up. That means there will be PE compression across the board in every asset class be it equities or commodities. India has foolishly kept interest rates too high fighting a structural inflationary rise in food prices that were below world prices with high interest rates. That foolishness has tanked the economy & choked banking. At some time the RBI will have to ease interest rates in INR markets against the world trend. That means $INR must account for that fact before hand.

- Tanking equity markets across the world will put unprecedented pressure on equity prices at home. The mess in the coal sector and power sector has clogged banks in cross-defaults. Growth will tank further unless government sorts out the mess in jinxed coal mine privatization & stalled power plants. Unrelated businesses must be insulated from cross-defaults for sometime. Pick up in growth will not be automatic since the fall is not cyclical but also structural. RBI must highlight steps under an “emergency plan” that need to be taken immediately, election or not. There is time.

- FII flows will not dry up if we let markets function normally. We shouldn’t worry too much about the losses forced on FIIs. They understand the inherent risk in equity very well. Let the markets function and weed out those who don’t add value. That is a bit counter-intuitive to lay folks but absolutely essential to attract new money into the market. Industrials who weep over the high cost of Dollar should be told to earn some.

- Don’t curb any import except Gold, that too strictly through punitive duties with a built in 12 month sunset clause. Make the sunset clause credible & builtin so that smugglers don’t invest in beating the system.

Last but not the least, even if NIFTY tanks to 4800, it is not the end of the world. As usual there will be a wall of cash waiting to invest at the right price provided we get the reforms back on rails. If FIIs have lost, their gain loss was a gain elsewhere. So there is no dearth of cash for investment in the system as such. It was RBI who destroyed our $Job economy. It is for RBI to resurrected it by instituting news ways of managing the INR. China is a good place to learn the art from. And yes, get labor reforms through.

Gold:

Gold closed the week at $1312.20, more or less on, but just under its, 50 DMA. Gold is in the process of confirming its near term bottom at $1179.40 made on 28th June. The metal could move down towards the $1200 price area over the next few weeks. However, the metal is also building a base for the counter-trend rally to follow. So the price will be a tussle between these two underlying trends till the middle of September or so. All told, the metal is now a buy at dips, especially in any crash in risk assets, for a tradable rally to the $1550 price area.

The longterm trend however continues to be bearish.

Silver:

Silver closed the week at $20.4070, a notch above the metal’s 50 DMA. Silver like Gold, appears to be in the process retesting the low of $18.17 as the new near-term bottom. With the close above 50 DMA, the probability of a dip to $14 now recedes. Silver too will fall in tandem with other risk assets and I would not take $18.17 as a “confirmed” bottom. However the next low by middle of September would be the base from which a decent tradable rally in Silver ensues.

No change in the long term trend which continues to be bearish.

HG Copper:

HG Copper spiked to a high of 3.3175, higher than its 50 DMA at 3.16 but below the 200 DMA now positioned just under 3.40. The spike came on higher than usual volumes. My sense is that the spike was just a one-off bear squeeze and there is no change in the underlying bearish trend. One would have to revise that view id the metal breaks above 3.40.

However, barring a fallback to 3.20 to test it as the new support, the short-term trend in the metal is bullish. The metal will most likely reconfirm 3.0 as the new support zone along with other risk assets before moving on. That said, it is the strongest metal on the charts. Anything below 3.20 may be worth accumulating for the long-term.

Brent Oil:

Brent closed the week at $104.87 after bouncing off its 200 DMA [positioned at $100] over the previous weeks. Brent could rally to $112 early next week but the commodity is all set to retest $100 or even lower over the next few weeks along with other risk assets. I would not bet on the rally’s base trend line holding up either. That said, Brent in unlikely to do anything below $90 and would be a screaming buy in any general commodity price crash.

US Dollar [DXY]:

The Dollar Index [DXY] closed the week at 81.17 after making a low of 80.89 during the week. As mentioned in earlier columns, DXY is in the process of confirming a near term bottom in the 80-81 price area before moving into a Wave V rally that could target 85.50 [at least] or even higher.

I suspect the process of confirming is all but over & will most likely be completed next week. The following Dollar rally could be explosive.

EURUSD:

EURUSD has been in a counter-trend rally to test the overhead resistance at 1.34 before heading down again to 1.27 over the next 2/3 months. What we see on the charts is a potential double top at 1.34 that is also reflected in the RSI and Stochastics. The currency pair closed the week 1.33442 after making a high of 1.34 during the week. Barring a possible pull back to 1.34 or even slightly higher, I sense the pair will turn down to head towards 1.27 region over next 2 months. First target for the pair lies at 1.32 which is its 50 DMA price area.

USDJPY:

The Dollar broke through the 50 DMA line against the Yen to close the week at 96.20. The Dollar is looking pretty weak against the Yen at the moment and could retest 94 early next week. But as mentioned with regard to the Dollar Index, DXY is in the process of testing a Wave IV bottom close to 80 and in the process the Yen appears very strong. While a trip down to 94 and the 200 DMA is not ruled out early next week, my sense is that the Dollar can launch into an explosive rally any time next weak and so shorts in USDJPY are inadvisable. Expect enhanced volatility in the pair going ahead. I would look to play long Dollar at the pair’s lows.

INRUSD:

For a broad perspective on the value of the INR [in USD expressed as cents] I examine the reciprocal of the USDINR chart with weekly prices to see how weak the INR is and to get a sense of where it could go.

INR started it current bout of devaluation/adjustment in July 2011, when its value was 2.3 cents. Yes that’s our INR. Was 2.3 cents; currently is about 1.6 cents. Taking the simplest model, the first Wave A of the adjust took the INR down from 2.3 cents to 1.7 cents. That’s a depreciation of 0.6 cents or a 26% devaluation from the value in July 2011.

In the normal course, one expect the corrective rally B from 0.17 in June 2012 to rally at least to 2.1 cents in April 2013 as shown by the Yellow corrective arrow. The corrective rally got nowhere near that target and grossly under-performed managing to get to just 1.9 cents. To me that is one very important measure of the structural weakness inherent in the INR.

We are in Wave C. How far can that take the INR? Note Wave A took the INR down 0.6 cents. We would expect Wave C to be usually as destructive as Wave A though it can be much more than that. 0.6 cents down from 2.1 cents [the point to which INR “should” have rallied] is 0.15 cents which translates into a USDINR rate of 66.667 to the Dollar. But if you take the “revealed weakness” in Wave B into account, the INR falls from 19 cents to 13 cents giving an $INR rate of 76!

Note these are gross approximations to reality; not reality. So we would expect Wave C to terminate somewhere between the $INR 66 to 75 mark. That sort of correlates to the anticipated move up in DXY from 80/81 level to 85.50 that I think will unfold in the next 2 to 3 months abroad. Note also that every other currency is will take a battering against the Dollar. It is not just the INR.

Raghuram Rajan, the new RBI Governor should clean out the Augean Stables, sort out the mess in exchange management, and start with a clean slate. Artificially propping the INR with stiff short-term interest rates hikes and trading curbs is the short road to disaster. The storms brewing abroad are beyond the control of Central Banks. The wise will profit, others will go down the tube. Export or perish, should be his blunt answer to MoF and Industry. Don’t curb any other import except Gold, that too strictly through punitive duties with a built in 12 month sunset clause. Make the sunset clause credible & builtin so that smugglers don’t invest in beating the system.

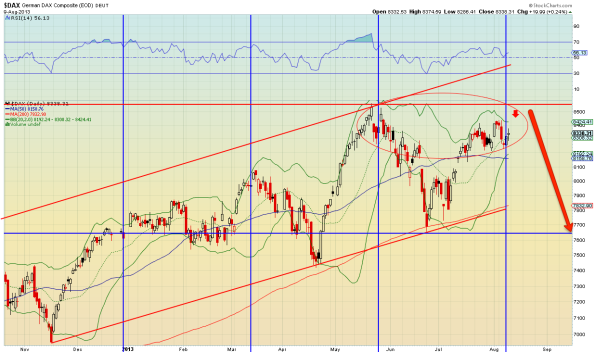

DAX:

I have bad news for DAX bulls. The index closed the week at 8338.31, well below the highest point hit during the week. Far more importantly, the index failed to rise to 8542.92, the high of the last rally. That means the index tips into a correction starting next week with a target of 7650.

We now have to wait and see far down the index will correct. If this move takes the ensuing move takes the index below 7650, we are into the much anticipated intermediate correction already.

There is a small probability of the index pulling a surprise and making a dash for 8550. Use to exit if not done already. The dash will not change anything much. We are headed for the 7650 area in any case.

Shanghai Composite:

Shanghai Composite closed the week at 2052.24 below it 50 DMA. That was a huge surprise because the minimum one would expect from such a battered down index at this late stage in the bear market is to at least spike up to its 200 DMA 2170 price area. It could still do that but it is probably too late for that.

What the failure to to rally to 200 DMA implies is that Shanghai too would follow the world indices into another correction which will probably test the low 1850. That then could be the trigger for an intermediate counter trend rally within a bear market.

NASDAQ 100 [QQQ]:

QQQ [a traded proxy for NASDAQ 100] 76.49. Nothing on the chart says it will not go on to make a new high during the course of next week. It probably will. But the advances are coming from poor breadth, poor volumes and from suspect sources. For instance, main line technology counters such as IBM are already in decline while stocks such as Apple propel the index via counter-trend rally within a long bear trend. Those are warning signs of an impending correction if not worse.

Note the failure in Shanghai and DAX, two of the major overseas markets have in all probability already slipped into a correction. So be warned. A big move down to 68.90 on QQQ awaits. And that is the minimum target. If the rally from there disappoints or if the market overshoots it, we are headed down for a long while.

S&P 500 [SPY]:

A new high on SPY, albeit not very far from 171, can’t be ruled out. Its value to bulls will be rather symbolic. And then a correction down to 156 or thereabouts should follow. If the market overshoots 156, we have an intermediate correction. If it falls short, the bull market remains intact. There is no way to tell apriori what will be the outcome. Volume, breadth, stocks in the indices, declining number of new highs all point to an intermediate top but time alone will tell.

NSE NIFTY:

NIFTY continued it correction by knifing through one support after the other. Even the long-term trend line support in place sine 2003 was taken out and that has major implications for the NIFTY.

The above is a weekly chart of the NIFTY to put the current correction in perspective. If my wave counts are true, [these are counts that have worked well so far] we are into the last stages of a correction for stocks that peaked in November 2010 [ not January 2008] and these stocks comprise such things as private & public sector banks, finance companies, consumer staples, technology etc that make up some 50 to 60% of the NIFTY’s market capitalization. The chart makes it clear we are in the initial stages of a giant C wave [this is a weekly chart] whose target would well be to retest 4800. That’s huge bear move ahead.

Note the move is coordinated not only with Emerging Markets but also the world’s leading equity markets. So the compression in PEs will compound the problems from a fall in value caused by declining profits. Worse, both will happen in the context of a tightening money markets world wide amidst an interest rate cycle that is turning up. Not to mention a general election that for once is questioning fundamental assumptions. I doubt if India has seen such a correction in its history before.

Be warned.

NB: These notes are just personal musings on the world market trends as a sort of reminder to me on what I thought of them at a particular point in time. They are not predictions and none should rely on them for any investment decisions.

MARKET NOTES: As the markets hit new highs, look to take profits.

MARKET NOTES: As the markets hit new highs, look to take profits.

NB: These notes are just personal musings on the world market trends as a sort of reminder to me on what I thought of them at a particular point in time. They are not predictions and none should rely on them for any investment decisions.

This blog had ventured to suggest that the last correction may not be the beginning of a intermediate correction and that we will have a subsequent shy at new tops. That scenario appears to be working out. Nasdaq 100 has already made a new high, SPX is pretty close to one, and others such as Nikkei, Shanghai and NIFTY are not far behind. But this blog had also suggested this rally may be the last before a substantial correction. Maintain that view unless the new highs are 5 to 6% higher than previous tops. So keep exit plans handy. D day could be 2nd week of August.

There is a rather lengthy note on the $-INR in the blog. Have always argued our whole foreign trade and foreign exchange management is riddled with flawed assumptions, not so much for lack of knowledge and understanding, but rather to protect vested interests. Cotton exports against lower cotton prices for local manufacturers is the sort of problem at one end of the spectrum. The failure to see value-addition as the key variable of domestic prosperity rather than the absolute export numbers is the other. Take cotton. What are we exporting? Sunshine, water, labor and some fertilizer & pesticide. What do spinners add to cotton by spinning it into yarn? Barely 10% at enormous cost. But if you take the distribution of profits between growers and spinners, the lion’s share goes to spinners. Such is the perversity of our economy. Forex has been the key fulcrum on which the edifice to transfer wealth from farmers to industry was built under the socialist raj. The apparatus is still largely intact. Most economist know of it. Nobody talks of it.

No change in the prognosis on NIFTY. Use the counter trend rally to exit.

Happy trading.

Yield on 10 year Treasury Notes:

http://stockcharts.com/h-sc/ui?s=$TNX&p=W&b=5&g=0&id=p16570754730&a=308769391

The yield on 10 year treasury notes continued at elevated levels but moderated a bit, closing the week at 259 basis points after having made a high of 274. On the long term weekly charts, 280 basis points appears to be a good place to pause from some consolidation before the uptrend resumes. The climb in yields has been pretty steep

since May. We could have a few weeks of consolidation with yields dropping back to around 200 bps as the correction sets in.

Gold:

http://stockcharts.com/h-sc/ui?s=$GOLD&p=M&b=5&g=0&id=p91093061335&a=308778277

Gold continues to surprise to the downside. It closed the week at $1277.60 after rallying from a new low of 1212.10. The monthly chart of gold prices above shows that while $1160 was a support area, Gold is more likely to test the $950 area before it finds some solid support from long term, long only investors. The wave counts, the support line for the long term uptrend support line and the fractal being traced out by gold prices all point to further weakness in gold prices. There is plenty of time for gold prices to drift down as well. Indians would be wise to leave the metal alone for some time but then I have been warning of a bear market in gold for the past 2 years and more. Don’t see a significant rally in gold prices until after March 2014.

Silver:

http://stockcharts.com/h-sc/ui?s=$SILVER&p=M&b=5&g=0&id=p94549700653&a=308782266

Silver’s first major support zone was $20 made a low of $18.17 before staging a minor rally to $20.25, closing the week at $19.792. The above monthly charts shows the next major support for Silver is at $14 and it has plenty of time to get there. I don’t think the metal will find any significant rallies from here until it test $14 although it can hang around current levels for a while.

HG Copper:

http://stockcharts.com/h-sc/ui?s=$COPPER&p=M&b=5&g=0&id=p58042402073&a=308783851

Copper has been rather reluctant to test levels below 3.0 and has bounced from the region on several occasions in the past. My sense is that while Copper has more or less finished its price correction, it could mark time in the 2.80 to 3.40 price region before staging a significant rally. Definitely not a metal to short at these prices.

WTI Crude:

http://stockcharts.com/h-sc/ui?s=$WTIC&p=M&b=5&g=0&id=p58042402073&a=308784188

WTI Crude’s price has been trending up on thinner and thinner volumes for the past 2 years! That fact alone should make one very wary of WTI Crude’s chart. The second fact that put’s crude long term chart out of kilter is the fact that it peaked in 2007, long before the rest of the commodities did so. In my view that is significant price “failure” in on the long term charts and crude’s rather anomalous price behavior points to the same fault line. There is no doubt in mind that the technicals point to a price of WTI crude in the $80 region in the intermediate term ahead.

That said crude has been in a counter-trend rally from a price of $84 since the June of 2012 and that bear rally could have peaked out $107.426. My sense is that elevated crude prices reflect some sort of a technical bear squeeze that cannot persist for long. However, keep in mind crude’s tendency to shoot for the highs at the slightest provocation. My sense is crude will return to test $80 levels before long. But avoid shorts.

Reuters CRB Index:

http://stockcharts.com/h-sc/ui?s=$CRB&p=M&b=5&g=0&id=p58042402073&a=308785978

The CRB Index puts the triangulation underway in commodities into global perspective. The index itself has little predictive value but it does confirm the notion that triangulation in the open auction markets is perhaps the only way to true price discovery. Note the 250 support line for the index. With the index poised at 270, we are not far from support. My sense is agricultural commodities will recover way ahead of the industrials & precious metals. But that’s a subject for another day. Long term bears will be looking to exit shorts in most commodities.

US Dollar Index [DXY]:

http://stockcharts.com/h-sc/ui?s=$USD&p=M&b=5&g=0&id=p58042402073&a=308786829

This week’s blog is all about underlying long term trends since markets appear to be approaching an inflection point. Who looks at monthly currency charts in markets? Well I do and its very instructive to place things in perspective. First note that DXY bottomed in 2008 and then confirmed that bottom in 2011. Its been in an uptrend since then and those surprised by my bullishness on the $ for the past 2 years contrary to all conventional wisdom now know why. That uptrend is about to end. If it ends now, or after another 6 months is the moot question.

Note DXY has broken out of a fairly large and significant triangle and has since confirmed the breakout to the upside. That’s the basic reason why I have been suggesting a target of 85.50 for the DXY. The index can overshoot that target to test 89 before an intermediate correction sets in. So 2 things stand out. Firstly, the long bull run in the DXY is now approaching its final run up. So things will be volatile. And secondly, wave Vs can be terrible in what the do to price extension. We are in wave 3 of Wave V from the bottom of 72.50 in 2011 by my count. Fasten seat belts.

EURUSD:

EURUSD staged a smart counter-trend rally from the 1.27 price region to 1.32 before closing the week at 1.3066 sandwiched between its 200 and 50 DMAs. The rally from 1.27 upwards was reactive and the correction underway from 1.37 in February is far from over.

My sense is EURUSD will return to test 1.27 over the next 4 weeks before turning up. I don’t think we will see EURUSD below 1.27 in this correction.

USDJPY:

USDJPY closed the week at 99.21, a shade below its 50 DMA at 99.50. Recall USDJPY bounced back from 94 after falling from a significant new top at 103.60. While the bounce from 94 is corrective in nature, and therefore we will see sharp corrections on the way up, my sense is that the corrective way is exhibiting sufficient strength to show higher top than 103.60; something one wouldn’t expect in a cup-and-and-handle correction from 103.60.

Not bearish on the Dollar against the Yen. And that is sort of confirmed by the technical position in both DXY and the EURUSD.

USDINR:

My data vendor & charting service let DXY, EURUSD, USDJPY and USDINR in particular fall between their two stools. One doesn’t have the data and the other the charts! So excuse the charts and follow the narrative carefully using whatever charts you have to track prices. For I am going to show you why I think USDINR will be close to 70 by the end of this year.

Recall, the journey of 20% devaluation of the INR every decade or so began with reforms in 1990. It is RBI’s biggest folly that it devalues the INR in sudden bursts of 20% in a matter of weeks and then lets the INR appreciate in the interim. While that is politically convenient for RBI and Govt., because the bad news can be fobbed off as a one time crisis due to “external factors” as is being done now, it is an absolutely ruinous practice as far as exporters are concerned. Why? In the normal course exporters face an appreciating INR under the current scenario and that takes away 2 to 3% of their sales assuming a collection period of 3 to 6 months. While in an depreciating INR scenario, because it is usually a sudden haircut that disrupts normal markets very few exporters can actually lock-in the benefit of a depreciating INR.

That incidentally is one of the least perverse practices of RBI’s exchange rate management. Unfortunately, RBI treats Forex management as a black art and the few bankers that actually have expertise in the area are more interested in complicating rather than simplifying things to earn fat fees and spreads. The truth is, China style, constantly but slowly [not more than 3% pa.] depreciating INR pegged to the $ would best serve India’s interests. And it would eliminate all the unnecessary volatility in exchange management & reduce bankers’ fat spreads across the board. But who is to tell RBI? Our pink paper editors can’t be bothered to note the difference between direct & indirect quotes in the FX markets mangling the English language daily. So bear with me as I demystify what’s going on.

Back to basics. The first mega-wave of the up move of the $ began in 1990/91 when the $ went from INR 10 in 1991 to INR 49 in 2002. That was a 5 part bull move of the $. I have part of the chart in my database but can’t show it here. From the 49 in 2002 point began the correction to the up-move from INR 10. This is where the full folly of RBI become so obvious and has proved so ruinous to our software & services industry, particularly low value added call centers, transcription services and the like. From INR 49, RBI allowed the $ to depreciate against the Rupee to INR 39 in 2007. Which is to say, over the 5 year period, 2002 to 2007, every marginal player in the software & services industry was wiped out by competition from Brazil & Philippines. Export data from both countries bears out that India’s loss was their gain. Remember low-value-added services work on paper thin margins, and nothing but rents and telephony as expenses apart from labor. With little value added except labour even a 3% constant erosion of their profit margin annually wipes out their viability.

On the other hand, these businesses create a huge middle class of workers who essentially earn Dollar salaries. It is their consumption that drives the demand for everything from small cars & washing machines to housing. When those jobs go abroad, their demand tanks & so does our GDP. What’s so complicated about this? RBI should be well aware of all this. If it still allows a small number of foreign banks to structure the forex market to India’s disadvantage, knowingly or unknowingly, it has only itself to blame.

And so there was the giant B wave correction from 49 to 44, the A of which did a 5 part impulse wave to 39 in 2008, followed by a corrective B to 52 in 2009 and from the the terminating C down to 44 again in 2011. Was all this volatility necessary? Absolutely not. It only enriched foreign bankers and wiped out our exporters & new jobs created by them. I kid you not.

From the level of INR 44 July 2011, the Dollar began the III wave up and we are in the middle of the first of its sub-waves up and the $-INR is already 60. The chart above begins to track the moves at the $-INR level 44 in July 2011.

The first A wave took the Dollar from 44 in July 2011 to 57.3 in June 2012. From there, the Dollar has had an orderly correction down to INR 53.5 which ended January 2013. That puts the current wave up as “C” which could extent to give the full 5 part impulse wave later on. For the moment we will assume just a 3 part A-B-C wave up.

What do you have? As the chart shows, the “a” part of the C wave [which itself breaks down to the usual 5 part impulse wave up] took the Dollar up from 53.50 to INR 61. We are now correcting for that up-move and the Dollar could retest 56 from the topside in the next 2 to 3 months. As night follows day, there will be the “c” wave up from INR 56 after the correction some time towards November 2013 or January 2014. Where will “c” wave take the Dollar? Connect the tops from July 2011 parallel to the rally’s support line and you get a target for the Dollar of 71. Safe to say the technicals point to the Dollar ending 2013 at about INR 70.

Note, we have assumed a mere 3 part A-B-C up from 44 in July, 2011. That can extend to a 5 part impulse wave whose target would be much higher. Anybody wants to bet on the $-INR just before the election results? Yep you got that right. If C wave extends, the 5 part impulse would take us to elections 2014. Gawd help us all.

Trust me RBI needs some very sharp lessons in letting foreign banks run the forex markets to India’s detriment. One way for it to demystify things is to realize that all that that the foreign bank really does it to borrow Dollars in Singapore and sell the same in Mumbai. The rate it sells them in Mumbai includes its funding cost plus commission. And a small premium because for every 100 $ sold it will get back only $85 from the market given our trade & investment deficit. The balance 15 has to come from RBI’s reserves. To postpone that 15% immediate outflow, RBI virtually hands over a monopoly to foreign banks since Indian banks face a stiff funding cost in Singapore. For pennies we hand over something of huge strategic importance to firangi bankers. No wonder the make such fools of us.

So, a correction of the Dollar back to 56 and then the final swing up to 71 by year end. It is not magic, just logic of the markets.

DAX:

http://stockcharts.com/h-sc/ui?s=$DAX&p=W&b=5&g=0&id=p73783627979&a=308790722

DAX closed the week at 8212.77 a whisker above its 50 DMA at 8173. So far DAX is behaving as expected in this blog. Wave counts favor a retest of the recent top at 8550. In fact we could have a higher high. But unless the higher high is at least 5 to 6% higher than 8550, the subsequent correction that follows in Mid-August could tip the index into an intermediate correction. Look to exist. Sometimes the risk is simply not worth the potential return.

Nikkei 225:

http://stockcharts.com/h-sc/ui?s=$NIKK&p=M&b=5&g=0&id=p58042402073&a=308791043

The above monthly chart clearly lays out the neat arrangements made for a new high by the managers of Nikkei 225 even as it corrects from the recent top of 15962. In the initial phases of a bull move, dip buying by left out bulls often lends a momentum to markets greater than the initial impulse. In the normal course one would expect a cup & handle correction to the rally from 8180 to 16000 which is basically Wave I of a new bull super cycle for Nikkei. However by going into a correction slightly earlier than expected & from the down-sloping bearish trend-line a trap has been laid for bears. If enough get trapped, their covering alone will ensure a new high. Note the candle to 16000 without a body but a huge spike. Price without buying which points to the bulls’ intention to return after the bears have been trapped. So avoid shorts on the Nikkei. In any case it is in a correction with little downside until the B up currently underway exhausts itself. Note the time element. A new high would sync with SPX also due for a new high mid-August. Hint, hint.

Shanghai Composite:

http://stockcharts.com/h-sc/ui?s=$SSEC&p=M&b=5&g=0&id=p74484342309&a=308791466

As mentioned in my previous posts, Shanghai has completed the second leg of its correction from the top of 6060 and has now caught a counter-trend rally up that could eventually test 2450. It is not yet the beginning of a new bull move although it might look like it. China has a lot of time correction to go through although the price correction is now over. All the same it is nice tradable rally and the downturn can easily coincide with world markets come mid-August. So don’t be late to the party & get caught.

Nasdaq 100:

http://stockcharts.com/h-sc/ui?s=$NDX&p=M&b=5&g=0&id=p58042402073&a=308792049

You get such long duration rallies as in the Nasdaq 100 only from an absolute nadir which is what the low of 2009 was for the index combining the low of both the correction for the bubble and the crash of 2008. In any case, the warning is clear enough. We are well into a mature rally that is ripe for correction.

I wrote in this blog during the last fall that we will have another last leg up and most probably a new high. Nasdaq 100 closed the week at 3079.07 giving the promised new high. There is still 2 or 3 weeks for this rally to run. Regardless, I would be looking to exit positions. You got your new high against all odds. Take your money & run.

SPX:

http://stockcharts.com/h-sc/ui?s=$SPX&p=M&b=5&g=0&id=p58042402073&a=308792081

SPX closed the week at 1680.19 just short of the previous top of 1687. With that, SPX kept its promise of wave counts that showed there would be another rally after the last fall with the possibility of a new high. I repeat what I have been saying for Nasdaq. In terms of wave counts, we have run out of telomeres. To get an extension you would need a new high 5 to 6% higher than the previous top such that the next correction down doesn’t go lower than 1560. That’s a tall order so late into a mature rally. So the prudent would take their money and run. Don’t play the short game though. Not yet. Best to wait for confirmation of an intermediate down-trend.

NSE NIFTY:

http://stockcharts.com/h-sc/ui?s=$CNXN&p=M&b=5&g=0&id=p58042402073&a=308792266

By one count, shown above, but not the one I favor, [both show a similar prognosis but this one is easier to explain] suggests NIFTY is approaching the end of its correction from the 2008 top. Curiously, the market might hit the bottom just as the election results for 2014 come due. Coincidence? No the trick’s been accomplished by an extension to the bearish wave count but I will explain that in another blog-post. Meanwhile the old prognosis stands. NIFTY is headed up into a counter-trend rally that can see it make a new high in the region of 6300.

What follows will be the terminating C for many old economy stocks like steel and financial scrips like PSU banks that will cause some mind-boggling damage to valuations. PSU banks in particular, which are some 15 to 20% of the market, look likely to be hit the hardest.

Look to exit and reenter later after the carnage. Besides, it is election time. Regardless of who you favor markets will tank well before them. Then there is the INR to contend with.

NB: These notes are just personal musings on the world market trends as a sort of reminder to me on what I thought of them at a particular point in time. They are not predictions and none should rely on them for any investment decisions.

MARKET NOTES: US Equities resume uptrend amidst a surging Dollar and crashing commodities.

MARKET NOTES: US Equities resume uptrend amidst a surging Dollar and crashing commodities.

The interest rate cycle continued its ponderous upturn. The churn is far from over and yields on 10 year US Notes flared up to 274 basis points. We may be headed into yields as high as 300 bps pretty soon. The fixed income markets continue to be in a flux while equity markets now appear to take rising yields as an affirmation of future growth of GDP. Commodity markets continue to tank with rising yields.

A resurgent US Dollar is the key feature of the current scenario and its value continues to drive other markets from Euro, Yen to the INR. Most currencies continue to seek lower valuations against the green buck. This trend is likely to continue until the Dollar peaks out by year end around 89 as opposed to 84.5 right now.

A rising Dollar and higher interest rates are roiling commodity markets. A brief look at the CRB Index shows we may not have seen a bottom in the commodity markets as yet despite the long downtrend underway for the last two or more years. There is scope for further price and time correction in most of them including Crude.

Wave counts suggest we may be in the middle of the last rally up in the US markets before an intermediate correction sets in. For that view to be negated we will need new tops in this rally that are 5% or more higher than previous tops. Considering the mature bull markets we are in that may be unlikely. Hence those playing longs should keep tight stop losses and look to exit.

Shanghai presents a good buying opportunity never mind the horrendous news flow from there.

Back home, the $-INR dominates news flow. For the immediate term the worst may be over in terms of Rupee depreciation but year end values are likely to be nearer 65 than 60. Expect Indian equities to rally to 6300 and then correct along with the rest of the world equity markets.

CRB Index [Commodities]:

The Reuters/Jefferies CRB Index closed the week at 280.72. The above monthly bar chart shows commodities could correct a lot more from current levels before we get to a bottom. The chart is presented here just to give a perspective to the ongoing correction in commodities. Not all commodities in the Index will correct at the same time. But clearly, it is too early to call a bottom in commodities as some have been suggesting.

Gold:

Gold closed the week at $1212.70 after making a high of 1261.70 during the week. Gold could head back to retest 1160 before rallying a bit towards the 1320 overhead resistance on the charts.

Clearly, the long term bearish trend in Gold is not over and we could see multiple attempts to take out the 1160 support going forward. We may not see a robust counter-trend rally in gold until early next year.

Silver:

Silver closed the week at $18.81. What is noteworthy is that Silver made a new low of $18.19 and rallied up to retest the $20 as the new overhead resistance and then fell from there to close at 18.61. Expect Silver to take out the $18 mark next week. As noted earlier there isn’t any appreciable support for Silver below $20 all the way to $14. A gold like collapse in Silver prices appears likely on the charts.

HG Copper:

Copper closed the week at 3.065 after having rallied up to 3.1745 from its recent low of 3.0725. There is nothing on the charts to suggest that the downtrend in Copper is over. The metal appears headed to retest its longterm uptrend support in the region of 2.50. A breach of the crucial support at 3.0 would confirm this prognosis. On the other hand, a short counter-trend rally to 3.40 can’t be ruled out altogether. The odds favor a breach of support at 3.0.

WTI Crude:

WTI crude closed the week $103.22. First overhead resistance from current levels lies at $106.50. It is highly unlikely that crude will take out this resistance in the current rally. On the contrary, crude is more likely to cool off and head down to retest support at $98.50. Crude is over-bought. It has never strayed this far out from its 200 DMA in recent years. First support below $98 lies at $96.

Yield on 10 Year USTs:

The bond markets were back in turmoil after a short respite. The yield on 10 year Notes flared up to 274 basis points roiling commodities & bonds. The weekly chart of yields above indicates that the markets want to test the yields right up to 285 basis points which is the first major overhead resistance. Markets do overshoot and a yield as high as 300 bps may be on the cards in the next few weeks. The almost 1 way rally in yields from 160 bps to 300 bps signals a tectonic shift in the interest rate cycle whose full effect is yet to ripple through all asset classes. There is no guarantee that yields will peak out at 300 bps for now.

US Dollar [DXY]:

DXY is clearly over-bought and at a significant overhead resistance having closed the week at 84.6890. DXY has another major resistance at 85 and may pause there to consolidate a bit. However the uptrend is unlikely to halt there. DXY is in the initial stages of a Wave V up whose target could be in the 89 region.

EURUSD:

With Dollar in such a strong uptrend that other currencies are tanking and the Euro is no exception. EURUSD closed the week at 1.2830 slicking through the rally’s trend line support at 1.30. With this the Euro has clearly signaled its intention of testing 1.27 support. In fact EURUSD could head to as low as 1.24 after a brief counter-trend rally from 1.27 early next week.

USDJPY:

The USDJPY chart is a mirror image of the DXY chart. As mentioned last week the Dollar is headed to 103/104 Yen and is likely to trace out a cup-and-handle from the previous top at 103. The absence of any meaningful correction to the rally from 94 indicates much turbulence head for the USDJPY pair as it gets caught between a resurgent Dollar & Abenomics. I would not be surprised if the 103/104 Yen level is breached.

USDINR:

INR has many a reason to seek lower levels against the Dollar. India allows investment inflows to mask the true INR value as determined by trade flows which is rank bad practice over the long term. RBI needs to seriously rethink the myths its has been perpetuating. Worth reminding RBI that [a] in terms of “value added in India” our software & services exports of $50 billion a year as the equivalent of about a Trillion Dollars worth of merchant exports from China. This value created in India & paid for in Dollars is what drives growth in domestic consumption. Playing with these exports is more ruinous for India than anything else and [b] Philippines has the fastest growing GDP and services exports in the world thanks to RBI’s wrong headed exchange rate policies in the past. You just cannot allow the competitiveness of services exports to deteriorate without tanking the domestic economy. Furthermore, RBI must look to the weakest link in the export chain to determine INR value and not listen to industry leaders like TCS/INFY. The majors have a vested interest in eliminating domestic competition from small exporters and at the margin it is the weakest player that must remain competitive for India’s exports to grow. RBI has been talking INR rates to the wrong people!

That said, INR is clearly following trends in the value of Dollar abroad. After a brief correction, the USDINR pair closed the week at 60.215. In terms of wave counts and time, the pair has much more scope to the upside. My sense is that the pair will follow the DXY as the latter trends higher. Maintain my estimate of 63.50 to 65 INR per Dollar by end of this year.

DAX:

DAX closed the week at 7806 after having retested its 200 DMA at 7700 during the week. With this, my sense is that the correction in the index from the top of 8557.86 has been completed and the index is likely to resume its uptrend back to the previous top early next week. Too early to say if we will see a new top. But a retest of 8560 is very much on the cards.

NIKKEI 225:

NIKKEI closed the week at 14309.97. First resistance from the current level lies at 16000 and the index appears headed there. Barring minor corrections on the way, there is nothing on the charts to stop NIKKEI from getting there.

Shanghai:

Having emphatically clarified that 1920 is not a true bottom, Shanghai has been in a counter-trend rally and closed the week at 2007.20. Shanghai appears headed towards 2240 region which is its 200 DMA. Shanghai’s counter-trend rally now underway could see it test 2450 before long. While the index hasn’t bottomed out, the counter-trend rallies are likely to be as strong as the corrections that follow. Avoid shorts, play long.

Russell 2000 [RUT]:

RUT closed the week at 1005.39 just a bit short of its previous top of 1010. That the mid-cap space in the US is much stronger and in such fine fettle speaks for the direction in which equities are likely to head from hereon. Note SPX and DJIA present a comparatively weaker structure at this point which could be a bear trap.

NASDAQ 100:

NASDAQ 100 closed the week at 2963.22, just atop its 50 DMA. First overhead resistance lies at 3000 followed by the previous top at 3050. While not as strong as RUT, the technical picture for NASDAQ 100 is much stronger than SPX or DJIA. Will we have a new high? Possible but unless we have a substantially higher new high its utility is moot.

SPX:

SPX closed the week at 1631.89, just atop its 50 DMA at 1625. First resistance lies at 1655 followed by the previous top at 1687. A retest of the previous top at 1687 is almost certain. A new high can’t be ruled out. However, unless we get a substantially higher high [5% or more] the current rally may be the last of them for a while. Time for extreme caution in this rally. Keep tight stop losses.

NSE NIFTY:

NIFTY closed the week at 5867.90 after having tested support at 5750 during the week. The close was above the 200 DMA but below the 50 DMA which lies at 5925. NIFTY is headed in a counter-trend rally to the previous top of 6250 and there is no logical reason not to expect a new top. However, this is a counter-trend rally and even if we get a new top, it is unlikely to sustain for long. NIFTY’s rally to 6300 is tradable but keep in mind the reversal likely from 6300 along with the rest of the world’s equity markets.

NB: These notes are just personal musings on the world market trends as a sort of reminder to me on what I thought of them at a particular point in time. They are not predictions and none should rely on them for any investment decisions.