Archive

MARKET NOTES: WORLD EQUITY MARKETS 19.01.2014

MARKET NOTES: WORLD EQUITY MARKETS 19.01.2014

World Equity markets continue to exude cheer reflecting modest growth in the global economy accompanied by fairly lose and benign monetary conditions. Shanghai is an exception as authorities grapple with the problem of excessive speculation in asset prices financed via the Dollar carry trade. It is not a bubble that lends itself to easy resolution.

Back in India, NIFTY continues to climb a wall of worry as general elections loom, fiscal deficit surges and the current account deficit is barely under control following subdued gold & crude prices. This largely reflects the fact that much of the negativity was already in the price. All said & done, Indian GDP continues to grow at 5% plus rate and a financial bankruptcy on the external account is a still remote event.

Under the hood, there is considerable churn in stock in the US & European markets. Should the interest rate curve start sloping upwards reflecting normal real growth, the financials will stand to make a lot of money and their valuations are pretty cheap given the bad patch they have had since the year 2000. Look for values in this sector for further impetus to S&P 500.

Happy trading.

S&P 500:

Some people have asked for analysis focused on the near-term. So presenting the hourly chart in $SPY above.

To my mind, the drop from 184.75 on 31st December to 181.25 on 14th January corrected the run up from 177 to 184.75. $SPY has since rallied to high of 184.85 and is now correcting for that run up. I would be greatly surprised if the bulls yielded the gap just below 183.50 to the bears in this correction. Following the gap there is much more robust support at 183.

I would expect $SPY to resume its rally in the next to 184.25 and beyond. There is really nothing bearish on the charts so on the charts as long as 181 level holds.

Nasdaq 100:

The near term picture for the Nasdaq 100 [$NDX] is similar to that of $SPY.

In my view, the drop from 3591.25 to 3500 corrected the run up from 3430 to 3591.25. $NDX then went on to make a new high of 3610 and is currently correcting for that run up. First support lies at 3580, which held up on first test on 17th January. More support exists at 3570 followed by that at 3540.

My sense is that the gap between 3580 and 3590 will not be filled here and the index is likely to rally sharply to new highs beyond 3617. Position traders may like to keep their stops just below 3520.

Nothing remotely bearish on the index as such but under the hood tech stocks are showing some signs of exhaustion. On the other hand financials are likely at the beginning of a fresh surge up. So do take a look at what you hold than just the index.

NIKKEI 225:

Nikkei is in a very strong uptrend with first target of 16,700. I think the Index intends to clear the previous high of 18,260 in the next 12 to 18 months. That said, 16.700 would be a fairly formidable overhead resistance.

Nikkei made a high of 16320.22 on 12/30/2013 and has been correcting since then. Its 50 DMA is currently at 15,368, which should act a support and has been tested successful once. Further support lies at 15150 followed by a more robust floor at 14800. My sense is that 15350 floor is unlikely to be taken out in this correction.

On the other hand I see a high probability that Nikkei may stage a very sharp rally to just under 16,700 and correct from there in a fairly complex move. The next few weeks are for consolidation. But my sense is that consolidation will happen in a higher trading range of 15,800 to 16,700 rather than the current one. Nothing bearish about the Index.

DAX:

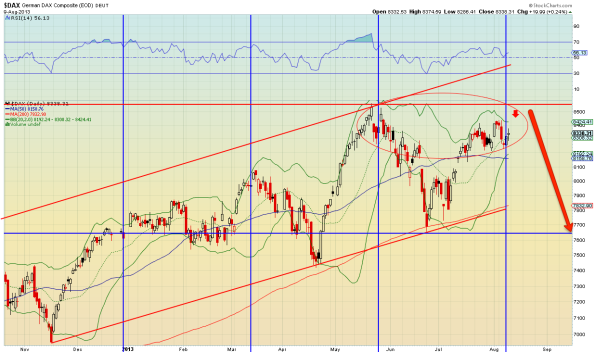

$DAX is in a strong uptrend that will see very brief though sharp corrections over the next two weeks. The Index is targeting 10,000 plus before the end of May.

There will be a bit of consolidation before the index makes a bid for 10,000 and my sense is that having seen a sharp running correction from 2nd December to 14th January, the index is more likely to spike up to just under 10,000 early next week and then consolidate a bit above 9700 for a week or two before making another attempt at the target.

Day to day plays isn’t my forte. Simply don’t have access to the kind of data necessary for a proper analysis of the technical play. So take the above with a bit of caution. However, I am pretty much confident that [a] 10,000 will be taken out much before May and [b] it won’t be taken out at first or second attempt.

Position traders should hold with a stop under 9700. There is nothing bearish in the index yet. And all indications are for an early take down of 10,000.

Shanghai Composite:

Among the major world equity markets Shanghai continues to be the most unambiguously bearish. The Shanghai Composite Index appears headed for a retest of its major floor at 1660 by end of May. There may be minor corrections on the way but the direction is clear enough.

The other noteworthy technical event is the generation of a clear sell signal so late in the bear market with the 50 DMA moving well below the 200 DMA. I wonder what the market knows what we don’t. Avoid calling a bottom on this one. Wait for clear capitulation. In the near term the index is clearly oversold and could pause a bit. But the respite won’t last long. Make a buy list but wait for capitulation.

NSE NIFTY:

NSE NIFTY appears to be climbing a wall of worry what with the Indian economy being ringed with huge fundamental problems at the macro level. But then markets have been so hammered in recent years 6 years of a bear market that I for one wouldn’t question the market’s wisdom. This blog is just about technicals and the message from them is one of cheer. The markets are headed up though only they know why!

The NIFTY made a technical low of 5118.85 on 8/28/2014 and in many ways it can be said to have marked the end of the bear market that began with the crash of January 2008.

The NIFTY has been in uptrend since then making a high of 6342.95 on 11/03/2013. It went into a sideways correction since then and to my way of reckoning, the correction to the run up from 8/28/2013 to 11/03/2013 ended 1/08/2014 at the low of 6160.35, making for a fairy shallow correction to the indices.

Since then the Index has rallied to high of 6346.50 and has fallen back a bit from there. The correction is minor and to be expected as the index can be expected to take 3 or 4 attempts to break free to new all time highs. My sense is that we could well see NIFTY at 6600 by the end of May or just before India goes into polls for a new government.

Nothing bearish in the NIFTY as far as technicals go. I would keep a sharp stop loss at 6100.

BSE Small Caps:

The BSE Small Caps Index [BSCI] made a low of 5100 on 8/28/2013 and rallied from there to a high of 6145 on 11/08/2013. It went into a running correction from that point but continued upwards and it is possible that the running correction ended 1/17/2014 although the possibility of another test of the 50 DMA at 6270 in the next 10 days should not be ruled out.

The index’s 50 DMA crossed over above the 200 DMA on 12/03/2013. Currently the Index is at 6476.76, well above the 50 DMA as well as the 200 DMA at 5851.25.

The Index Price ROC is in oversold territory. I expect the index to head for highs beyond the 6750 level. The steepness of the rally is largely owed to the way stocks were hammered on the way down. Having said that, there is nothing bearish on the charts. I would expect a clear breakout of the small cap index above 7700 by May end or before elections.

Stay with liquid stocks when dabbling in small caps.

MARKET NOTES: 18.01.2014. Is it really time to buy commodities? $DXY $INR $GLD

MARKET NOTES: 18.01.2014. Is it really time to buy commodities?

The commodity cycle has been in a downturn from May 2008 and has run through 6 years of a bear market. While that’s not unusually long for commodities, the cycle is nearing its end and prices look attractive in a historical perspective. But it is it time to buy?

I take look below at Gold, Silver, Copper and crude. Broadly, the technical picture is mixed but the probability of significant price drops towards the tail end of the bear market in things like precious metals is high.

As noted earlier, it is USDJPY pair that appears to be driving currency markets. Indications are that USDJPY may take a breather and correct to 100 from it current level of 104 over the next 4 to 6 weeks and that may drive the Dollar lower in other markets as well.

In India, INR has been appreciating against the Dollar ever since the Dollar made a high of 68.68 against the Rupee last year. That correction may now be over and the Dollar could head for INR 64 gain over the next 2 months.

Bulls should avoid calling bottoms although we are getting close to them. Waiting for capitulation in commodity markets is the better route to profits.

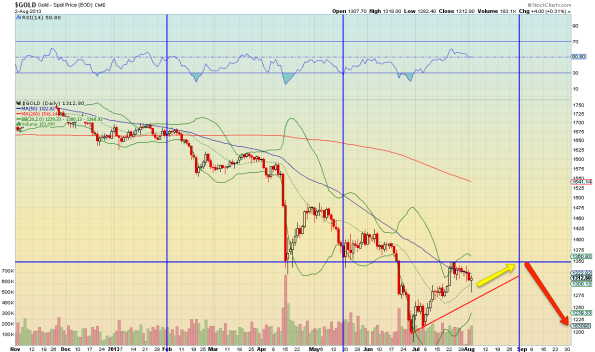

Gold:

Gold made a top of $1434 on 8/28/2013 and completed the down move on 12/06/2013 at a low of $1210.15. Since then it has been in a reactive move up, but actually ended up faltering, making lows of $1193 on 12/19/2013 and again $1181.40 on 12/31/2013. These two lows shouldn’t really have been there although it’s not unusual in reactive up-moves. They betray a weakness in the metal even at this late stage in the bearish move counting from the high of September 2011. One expects bounces at this stage of a bear move rather than a breakdown.

My sense is that we are likely to see more weakness in the metal further down the road that tests upward support trend line that stretches all the way from March 2001. New lows below $1180 appear indicated.

The metal is currently positioned at $1251 a notch above its 50 DMA that’s currently hovering in the $1245 area. In the near-term, we might have the metal continue to rally towards $1270 area by the end of this month. The market’s reaction to the price in the $1270 will decide the future course of price moves. A reversal from there will indicate further price breakdowns are in the offing.

A move beyond $1280 probably indicates a different wave count from the one I am using here that could take the metal all the way to $1360 or even $1440. But that appears unlikely given the weakness in price where one expects strength. Long-term, even if the metal rallies to $1440, the bear move down would be far from exhausted. India’s Central Bank can rest easy for a while more. Gold imports won’t pick up in a bearish market.

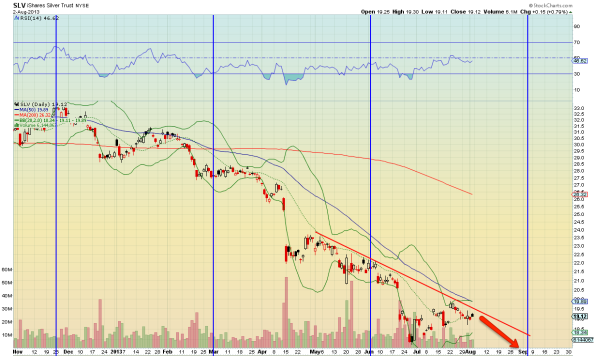

Silver:

Silver closed the week at $20.26, above its 50 DMA at $19.95 but well below its 200 DMA at $21.40.

The metal’s price moves follow gold though not exactly or with the same wave counts. By my reckoning, Silver’s latest leg down began from a high of 8/28/2013 and ended at $19.13 on 12/02/2013. Since then the metal has tried to rally upwards towards its major resistance of $22.

My sense is that the reactive move upwards will continue towards the 50% retracement level that coincides with a major resistance and the 200 DMA. Even if the 200 DMA gets taken out, I expect the metal to turn down once again and retest $18 before the complete bearish wave from the top of $49.50 in April 2011 exhausts itself. Note Silver broke down from its top in April end 2011 as against gold, which began its decent from September 2011. So expect Silver to lead the way!

HG Copper:

To my way of reckoning, Copper completed its last bearish impulsive move at 3.0420 on 3/30/2013 and has been in a reactive uptrend since then that has quite a way to go yet.

In the current uptrend under way, Copper made a low of 3.1570 on 11/19/2013 and rallied from there to a new high of 3.3740 on 12/24/2013. Its been correcting from there and could move down to 3.25 over the next 2 weeks to retest its 200 DMA as a support. Both the 50 DMA and the 200 DMA are placed close together in the 3.25 area.

On finding support at 3.25 as I expect, the metal could head for new highs beyond 3.45. Copper is not a bearish play and can be bought at a dip to 3.25 or even higher.

WTI Crude:

Crude is capable of a lot of surprises at this sage of the play. So I am gonna stick my neck out for the very short-term only. We will get a better picture of how things resolve in Crude by early April. Expect the market to surprise either way.

In the near-term, I see crude in a downtrend from the top of $112.22 made on 8/28/2013 and this trend ended in a low of $93.37 on 11/05/2013. Crude tried to rally from that point, with a few fumbles, but made it up only to $100.75 before turning down and taking out both its 200 DMA [$99] and 50 DMA [$95.4] to make a new low of $91.24 on 1/09/2014. The move up from there to Friday’s close at $94.37, just under its 50 DMA, is a minor reactive up-move that could exhaust itself in the vicinity of the 50 DMA. In the near-term – till March end – I see crude drifting down to new lows below $90.

Hard to say which way crude will breakout from 87 to 110 range of the last few years. But a break below $90 could be on the cards. And that’s more bullish news for India’s crisis managers back home. Don’t bet on the long side of crude till the end of March.

US Dollar:

I still think $DXY is in a reactive up-move from the low of 79.06 made on 10/25/2013 that has not exhausted itself. The up-move has already retraced 38% and could move up to 50%, which gives it a level of 82. The Index’s 200 DMA lies at 81.50. It will probably be taken out some time next week.

Any sustained move above 82 would invalidate my wave count and this analysis. The downside to the Index is very limited. So position traders should probably avoid large bets either way.

EURUSD:

The Euro made a triple top of sorts at 1.3825 and then turned down to take out its 50 DMA in the 1.36 region to close the week at 1.3539. To my mind the Euro is now in the second leg of its correction from the top of 1.3832 made on 10/25/2013 with a downside target of 1.3300, which happens to be in the vicinity of the pair’s 200 DMA currently at 1.3346.

Barring minor pullbacks, expect the Euro to drift towards a test of its 200 DMA over the next dew weeks. However, the intermediate up-move in the Euro from its low of 1.20 in July 2012 is not yet exhausted and I expect the Euro to turn up again after testing its 200 DMA.

USDJPY:

To my mind, the USDJPY pair has put in an intermediate top 105.44 on 01/02/2014 and has launched into the second leg of the correction for the run up in the pair from the low of 75.79 in October 2011. Note the up-move from 79, which probably targets 110 or higher is not yet exhausted. However the pair appears to be in complex “running correction” ever since it made a top of 102.88 in May last year and the current downtrend can be seen as a second leg of that correction although one must expect it to be much shallower.

With that in view, expect the Dollar to rally from the current level of 104.29 towards 105.50 but not breach the level next 2 or 3 days before turning down to reach for 100, which also happens to the current level of its 200 DMA. The process may take weeks but the trend after a brief test of 105.50 again should be down towards 100. A breach of 104 will confirm the trend. A decisive break above 105.50 will invalidate my analysis.

USDINR:

The Dollar has been in a correction against INR since the top of 68.80 on 8/28/2013. The correction continues but may be nearing a reversal.

The Dollar closed at 61.54 on Friday. The pair has made a bottom at INR 60.83 multiple times and this will likely act as a floor to further moves on the downside. The Dollar’s 50 DMA lies at 62.1 while its 200 DMA is way below at 60.34.

My sense is that the correction in the Dollar from the top of 68.80 got over with the low of 60.83 on 12/09/2013 and the Dollar is coiling up for a rebound to the topside. My analysis would be validated when Dollar bounces off to the topside from the vicinity of 61 in a decisive upturn. In which case I would look to buy the Dollar after the said bounce with a stop-loss just under 60.80 for a intermediate target of 64.

A break below 60.75 would invalidate my analysis. A note of caution, though. The journey to 64 after a bounce from the vicinity of 61 will be neither one-way nor swift. The Dollar is also correcting to the downside against other major currencies and this will mute the moves to the upside to begin with.

MARKET NOTES 12TH January 2014: World Equity Markets

MARKET NOTES 12TH January 2014: World Equity Markets

The US, Europe and Japanese markets ended 2013 at or near all time highs and have been working off the excesses in the first 2 weeks of the new year. All indications are that with end of the current consolidation over the next, the uptrend may resume shortly. Barring Shanghai, there is nothing bearish about most equity markets.

Back home, the broader universe of Indian stocks made new lows or significant lows after the crash to lows in March 2009. In some cases the rallies from these lows have been fairly sharp. It is too early to say if we have seen the “final” bottom to these stocks in August 2013 or if another attempt to test them will be made before or just after elections. For the nonce, the rally from August lows continues and some wave counts that favor suggest that this may extend to Mid-March. Investors should hold with an appropriate stop-loss. It is unlikely that Indian markets will step out of sync with global markets until elections loom.

Early bears fuel parabolic terminal bull-runs! Beware.

S&P 500:

The SPY chart, the traded ETF of S&P 500, is shown above. S&P 500 closed Friday at 1842.37 and appears to be on its way up to retest the previous top at 1850. Incidentally, 1850 happens to be on a very important trend line running up from the low of March 2009, through the top in March 2012, to the top on 31st December. The trend-line used to be a very important support line from March 2009 to August 2011, and has been a formidable resistance since then. Taking out the resistance would be a very rare but important technical event.

The Index’s 50 DMA lies at 1799, while it’s 200 DMA lies way below at 1689. The S&P 500 usually doesn’t stray that far above its 500 DMA. The fact that 1850 lies on a very formidable resistance, from where the Index reacted and the current “stretch” away from the 200 DMA suggests further consolidation. First support lies at 1808, which is pretty close to the 50 DMA, followed by more support at 1765. S&P 500 has usually turned up from the vicinity of it 50 DMA in recent corrections. We are therefore unlikely to see a breach of 1800 in the event of further consolidation.

There is nothing bearish on the charts for the medium term. Barring a drop to 1800 next week, the market should continue to trend up till the middle of May 2014. Dips to 1800 would be a buying opportunity for traders.

NASDAQ 100:

There is nothing bearish about the NASDAQ 100 [$NDX] in the chart shown above. $NDX closed Friday at 3536.08. First support for the Index lies at 3518 followed by more support at its 50 DMA now at 3468. Its 200 DMA is way below at 3151. The Index’s Price ROC oscillator is close to support. Barring a minor consolidation early next week in sympathy with $SPY, the index is headed up. Sharp rallies to the upside are more likely until Mid-May than sharp reactions. It is unwise to play bear in the Index.

DAX:

$DAX like the US Indices is into a major bull move that could last until Mid-May well above 10,000. That said, in the near term, the Index entered into a short-term correction on 30th December from a top of 9594 that may see the Index testing its 50 DMA, which currently lies at 9220. The consolidation itself could take the first few days of next week.

$DAX has a habit of testing its 50 DMA twice before major moves to the upside. The Index’s 14 day RSI is at 59 and heading towards 40. That more or less suggests one more attempt to test the 50 DMA before the rally to Mid-May. Beware if the rally to mid-May goes parabolic.

Shanghai Composite:

Clearly, Shanghai Composite is marching to a dynamic of its own ignoring other world markets.

The Index closed at 2013.3 on last Friday, well below its 50 & 200 DMAs, which are both in the 2125 region with the 50 DMA having generated a sell signal. The Index’s previous bottom lies at 1850 and there is no reason why the Index should stop short of the mark in the current downtrend.

The wave counts from the last major top in February 2013 suggest the Index may well seek levels lower than 1850. The next support below 1850 lies at the October 28th low of 1771.82. That could well be tested.

NSE CNX 500:

The CNX NIFTY, although widely traded, has become rather unrepresentative of the broader Indian market. The NIFTY is touching all time highs while 70% of the stocks listed on the NSE are barely 30 TO 50% above their March 2009 lows. Therefore, to give a better sense of the market, I track the CNX 500 and the NSE Mid-Cap Index that are more representative of the larger universe of Indian stocks.

The NSE CNX500 is an intermediate uptrend from the low of 3535 made on 12/20/2011 and that trend continues. The Index made a top of 4877.65 on 5/20/2013 before going into a correction that saw a low of 4054 on 8/272013. The corrective wave ended 11/03/2013 at 4847 and we are now seeing an effort by the Index to test the previous support for the Index at 4650. There are multiple supports before the Index hits 4650 and it could well halt much before that level.

My sense is that this consolidation of the CNX500 may continue for a few more trading days into the next week before the uptrend resumes. Investors should keep a stop-loss at 4600 & hold unless breached. With the US markets likely to turn up shortly, I am not bearish on the broader Indian market as yet, largely because the larger universe of stocks are at ridiculously low valuations.

NSE MID-CAP INDEX:

A noteworthy feature of the larger universe of NSE stocks is that a large number of them made new lows or significant lows in August 2013, after the crash of January 2008. In relation to these micro & midcaps, the question is if we will see another attempt to test the lows of August 2013 or is a bottom in place?

The second question nagging minds is the general election due in May 2014 and what impact that may have on the Indian markets.

The wave counts for NSE 500 AND the MidCap Index are analogous. The MidCap Index made a low of 6030 on 12/20/2011 and has been in an intermediate uptrend from there. It subsequently made a top of 8768 on 01/08/13 and corrected to a low of 6515 on 8/27/2013. My sense is that unless 7600 on the Index is breached, we may see the current rally from August continuing [with periodic corrections] up until mid-March 2014.

However, not all stocks may be strong enough to attempt a rally right up to mid-March. There will be those that started their correction on 12/31/2013 itself. Given the rallies in US, Europe and Japan, I would continue to hold stocks until stopped out by a breach of 7600.

MARKET NOTES: US Equity markets stage a routine pullback from 38% retracement level

MARKET NOTES: US Equity markets stage a routine pullback from 38% retracement level

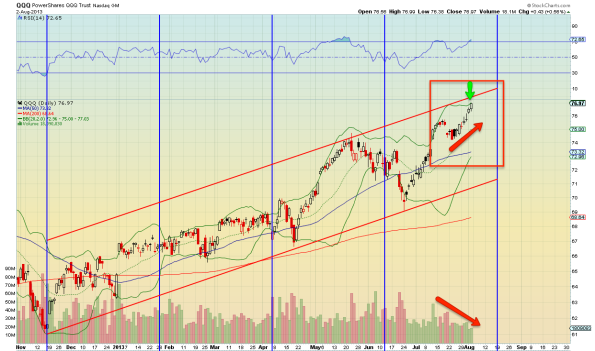

US Equity markets confirmed a correction by staging a minor pullback from the 38% retracement level on the main S&P 500 index. There was some extra excitement in the NASDAQ [QQQ proxy ETF] following an 8% rally in Microsoft welcoming Steve Ballmer’s retirement. The bear rally is unlikely to change the market direction in either NASDAQ or MSFT. It did give the bears a good scare though.

The Dollar’s preliminary moves after the low 80.90 are supportive of a like Dollar rally back to 85.50. We should see confirmation of that in the early part of next week. Until that happens, other currencies are likely to just mark time. In particular the EURUSD pair appears pretty undecided about where it wants to go.

Commodities were showing an upward bias on a number of charts. While the rallies in Gold & Silver are the usual counter-trend rallies one would expect in a bear markets, the trends in Copper and Crude suggest commodities may be bottoming out. For both Copper and Crude, I have had to revamp my wave counts to take into account the inherent bullishness.

Nearer home the panic in USDINR may have been overdone. Dollar rallied to a high of INR 65.50 which was my year end target for the pair. On more sober considerations, I think the market will settle down for some consolidation above 62 but below 65.50. A rally in DXY would impart an upwards bias to the Dollar in the Rupee market but much of the rally up to DXY 85 is already in the price.

NIFTY staged a routine pullback from 5250 level after a near panic liquidation. However, that didn’t look like the capitulation that the market needs. I expect the downtrend to resume in a more sedate fashion after a brief corrective rally.

There may not be an early end to world bearish trends. Look to exit rallies & hoard cash for better buys later.

Gold:

Gold rallied to a high of $1385.58 as expected in this blog before closing the week at 1370.80. The bear rally in gold is not yet over and we could see gold rally higher $1425 before it corrects for the price rise from $1180. But that correction is probably two to three weeks away.

Silver:

Silver too has been in a counter-trend rally from the low of $18.17 and made a high of 23.60 before closing the week at $23.1660. The bear rally may not be done as yet & the metal has the potential to rally to $26 before it corrects for the price rise from $18.17. The metal continues to be bearish in the long term.

HG Copper:

Have had to completely revamp my read on Copper following its recent price behavior. I now think the bottom of 2.98 formed on 21st June was the start of a new bull run in the metal that may see it reach for 4.0 by end of 2014. First confirmation of my revised read on the metal will come when it breaks [and sustains] above its 200 DMA and major overhead resistance at 3.4250. That could happen over the next two weeks. Upon confirmation of 3.4250 as the new support, we could be confident that the metal is in a new bull rally. In any case, as suggested before, there is no case for continued bearishness in the metal.

WTI Crude:

As in the case of HG Copper, have completely revised my wave counts on Crude in line with recent price behavior and revert to a simpler wave count. I now think the low of $77.41 on 21st June 2012 marked the start of another bull rally crude which could see it head for the previous top of $148 by end of 2014. First confirmation of this scenario would come if WTI crude fails to breach support at $99 in the current correction. Crude bounced from its 50 DMA at $103.15 last Friday. Further confirmation would take time but follow when crude breaks atop $110 and sustains above it. My earlier scenario that called for a correction down to $92 before a significant rally is still possible but the probability of that has receded significantly following repeated bounces in the price from $103 area. Hard commodities in general are showing signs of reversing long term trends. Crude and Copper being industrial in use may be the first ones to confirm the reversal in trend.

US Dollar DXY:

DXY closed the week at 81.53, just under its 200 DMA in the 81.60 price area. I continue to think the low of 80.8950 on 8th August marked the base from which a new bull rally in DXY has begun. First confirmation of this scenario will come upon a break above 82 and when DXY observes the 200 DMA as the new support for DXY. I think this could happen as early as next week.

A sustained rally in the Dollar will certainly pressure commodities across the board. Given my read on Copper and WTI crude, it will be interesting to see if these two commodities hold to their rallies despite a surging Dollar.

EURUSD:

Not offering an opinion on EURUSD.

USDINR:

USDINR made a high of 65.56 during the week, which incidentally my target for the Dollar by the year end in Rupees. The Dollar closed the week at 64.55. My sense is that the Dollar has overshot its immediate target due to acute panic in the Rupee market and needs to consolidate for a while before its next move becomes apparent.

Expect the Dollar to consolidate below 65.50 and above 62 for the next 4 to 6 weeks. A lot will depend of the contour that DXY follows in the international markets. I think a DXY rally abroad up to 85 may already be factored into the USDINR although that would give the Dollar an upward bias in the Rupee market.

In any case, the worst for USDINR may have worked itself out of the system already.

DAX:

DAX fell from 8438.12 to a low of 8300, just short of its 50 DMA and then corrected upwards to close the week at 8397.89. There is nothing on the charts that suggests that the downtrend in the index has reversed. I think the continues on its course to test 7650 support over the next few weeks barring normal pull backs of the sort we saw towards the end of last week.

NIKKEI 225:

Nikkei closed the week at 13365.17 and continued its orderly decent towards 12500 price area which is also where its 200 DMA is positioned. No change in the prognosis. Nikkei remains in an orderly correction to retest at least the 12500 price area.

Nasdaq [QQQ]:

QQQ closed the week at $76.67 after making a low of 75 during the week. The pull-back in QQQ surprised because it filled the price gap at 76 in the charts indicating a surprising strength in the index. That the pull-back gained from an 8% rally in MSFT does not take away from the strength of the pull back.

That said, the index continues in its corrective trajectory towards 69.50. Only a decisive new high would negate the drift towards 69.50.

S&P 500 [SPY]:

SPY showed the true underlying trend in the US equity markets without being clouded by the bear rallies in FB, AAPL and MSFT. The share has dropped from 172.14 to the 38% retracement level before staging a modest pullback that may continue in the next week. The index remains on course to test 155 which is also is 200 DMA price area.

NSE NIFTY:

NIFTY continued to be in a downtrend. It closed the week at 5471.75 after making a low 5258 during the week under near panic conditions. However, the pullback from 5258 to 5458 is the usual corrective move for oversold conditions and nothing suggests that the downtrend has halted much less reversed.

The corrective pullback may continue for a few days but expect NIFTY to resume its downtrend to the 4800 price area by end of the next week. I would be surprised if the NIFTY does not test 4500/4800 before the current downtrend exhausts itself.

NB: These notes are just personal musings on the world market trends as a sort of reminder to me on what I thought of them at a particular point in time. They are not predictions and none should rely on them for any investment decisions.

MARKET NOTES: A few points for India’s new RBI Governor

MARKET NOTES: A few points for India’s new RBI Governor

India’s new Central Banking Chief, Raghuram Rajan, is no stranger to markets in India and abroad. In fact he was one among those who warned of the banking excesses back in 2007 and what they implied for the credit cycle. So what I say will not be new to him. Nevertheless worth listing out a few things in the Indian context.

- A rally in Dollar is now widely anticipated. Whether it goes from DXY 80 to 85.50 or 89, the change in valuation of other asset prices will be huge. All world currencies will be impacted. $INR has to some extent ANTICIPATED the rally in DXY and wisely so. But an extension to the DXY rally from 85.50 to 89 will be devastating. That has huge implications for India’s exchange rate management. We need to use the crisis to put our exporters on a sound footing. This is not the time for short-term fixes no matter how tempting they are. Let the INR find a sustainable level that keeps potential exporters afloat.

- The surge in the value of the Dollar comes amidst an interest rate cycle that is turning up. That means there will be PE compression across the board in every asset class be it equities or commodities. India has foolishly kept interest rates too high fighting a structural inflationary rise in food prices that were below world prices with high interest rates. That foolishness has tanked the economy & choked banking. At some time the RBI will have to ease interest rates in INR markets against the world trend. That means $INR must account for that fact before hand.

- Tanking equity markets across the world will put unprecedented pressure on equity prices at home. The mess in the coal sector and power sector has clogged banks in cross-defaults. Growth will tank further unless government sorts out the mess in jinxed coal mine privatization & stalled power plants. Unrelated businesses must be insulated from cross-defaults for sometime. Pick up in growth will not be automatic since the fall is not cyclical but also structural. RBI must highlight steps under an “emergency plan” that need to be taken immediately, election or not. There is time.

- FII flows will not dry up if we let markets function normally. We shouldn’t worry too much about the losses forced on FIIs. They understand the inherent risk in equity very well. Let the markets function and weed out those who don’t add value. That is a bit counter-intuitive to lay folks but absolutely essential to attract new money into the market. Industrials who weep over the high cost of Dollar should be told to earn some.

- Don’t curb any import except Gold, that too strictly through punitive duties with a built in 12 month sunset clause. Make the sunset clause credible & builtin so that smugglers don’t invest in beating the system.

Last but not the least, even if NIFTY tanks to 4800, it is not the end of the world. As usual there will be a wall of cash waiting to invest at the right price provided we get the reforms back on rails. If FIIs have lost, their gain loss was a gain elsewhere. So there is no dearth of cash for investment in the system as such. It was RBI who destroyed our $Job economy. It is for RBI to resurrected it by instituting news ways of managing the INR. China is a good place to learn the art from. And yes, get labor reforms through.

Gold:

Gold closed the week at $1312.20, more or less on, but just under its, 50 DMA. Gold is in the process of confirming its near term bottom at $1179.40 made on 28th June. The metal could move down towards the $1200 price area over the next few weeks. However, the metal is also building a base for the counter-trend rally to follow. So the price will be a tussle between these two underlying trends till the middle of September or so. All told, the metal is now a buy at dips, especially in any crash in risk assets, for a tradable rally to the $1550 price area.

The longterm trend however continues to be bearish.

Silver:

Silver closed the week at $20.4070, a notch above the metal’s 50 DMA. Silver like Gold, appears to be in the process retesting the low of $18.17 as the new near-term bottom. With the close above 50 DMA, the probability of a dip to $14 now recedes. Silver too will fall in tandem with other risk assets and I would not take $18.17 as a “confirmed” bottom. However the next low by middle of September would be the base from which a decent tradable rally in Silver ensues.

No change in the long term trend which continues to be bearish.

HG Copper:

HG Copper spiked to a high of 3.3175, higher than its 50 DMA at 3.16 but below the 200 DMA now positioned just under 3.40. The spike came on higher than usual volumes. My sense is that the spike was just a one-off bear squeeze and there is no change in the underlying bearish trend. One would have to revise that view id the metal breaks above 3.40.

However, barring a fallback to 3.20 to test it as the new support, the short-term trend in the metal is bullish. The metal will most likely reconfirm 3.0 as the new support zone along with other risk assets before moving on. That said, it is the strongest metal on the charts. Anything below 3.20 may be worth accumulating for the long-term.

Brent Oil:

Brent closed the week at $104.87 after bouncing off its 200 DMA [positioned at $100] over the previous weeks. Brent could rally to $112 early next week but the commodity is all set to retest $100 or even lower over the next few weeks along with other risk assets. I would not bet on the rally’s base trend line holding up either. That said, Brent in unlikely to do anything below $90 and would be a screaming buy in any general commodity price crash.

US Dollar [DXY]:

The Dollar Index [DXY] closed the week at 81.17 after making a low of 80.89 during the week. As mentioned in earlier columns, DXY is in the process of confirming a near term bottom in the 80-81 price area before moving into a Wave V rally that could target 85.50 [at least] or even higher.

I suspect the process of confirming is all but over & will most likely be completed next week. The following Dollar rally could be explosive.

EURUSD:

EURUSD has been in a counter-trend rally to test the overhead resistance at 1.34 before heading down again to 1.27 over the next 2/3 months. What we see on the charts is a potential double top at 1.34 that is also reflected in the RSI and Stochastics. The currency pair closed the week 1.33442 after making a high of 1.34 during the week. Barring a possible pull back to 1.34 or even slightly higher, I sense the pair will turn down to head towards 1.27 region over next 2 months. First target for the pair lies at 1.32 which is its 50 DMA price area.

USDJPY:

The Dollar broke through the 50 DMA line against the Yen to close the week at 96.20. The Dollar is looking pretty weak against the Yen at the moment and could retest 94 early next week. But as mentioned with regard to the Dollar Index, DXY is in the process of testing a Wave IV bottom close to 80 and in the process the Yen appears very strong. While a trip down to 94 and the 200 DMA is not ruled out early next week, my sense is that the Dollar can launch into an explosive rally any time next weak and so shorts in USDJPY are inadvisable. Expect enhanced volatility in the pair going ahead. I would look to play long Dollar at the pair’s lows.

INRUSD:

For a broad perspective on the value of the INR [in USD expressed as cents] I examine the reciprocal of the USDINR chart with weekly prices to see how weak the INR is and to get a sense of where it could go.

INR started it current bout of devaluation/adjustment in July 2011, when its value was 2.3 cents. Yes that’s our INR. Was 2.3 cents; currently is about 1.6 cents. Taking the simplest model, the first Wave A of the adjust took the INR down from 2.3 cents to 1.7 cents. That’s a depreciation of 0.6 cents or a 26% devaluation from the value in July 2011.

In the normal course, one expect the corrective rally B from 0.17 in June 2012 to rally at least to 2.1 cents in April 2013 as shown by the Yellow corrective arrow. The corrective rally got nowhere near that target and grossly under-performed managing to get to just 1.9 cents. To me that is one very important measure of the structural weakness inherent in the INR.

We are in Wave C. How far can that take the INR? Note Wave A took the INR down 0.6 cents. We would expect Wave C to be usually as destructive as Wave A though it can be much more than that. 0.6 cents down from 2.1 cents [the point to which INR “should” have rallied] is 0.15 cents which translates into a USDINR rate of 66.667 to the Dollar. But if you take the “revealed weakness” in Wave B into account, the INR falls from 19 cents to 13 cents giving an $INR rate of 76!

Note these are gross approximations to reality; not reality. So we would expect Wave C to terminate somewhere between the $INR 66 to 75 mark. That sort of correlates to the anticipated move up in DXY from 80/81 level to 85.50 that I think will unfold in the next 2 to 3 months abroad. Note also that every other currency is will take a battering against the Dollar. It is not just the INR.

Raghuram Rajan, the new RBI Governor should clean out the Augean Stables, sort out the mess in exchange management, and start with a clean slate. Artificially propping the INR with stiff short-term interest rates hikes and trading curbs is the short road to disaster. The storms brewing abroad are beyond the control of Central Banks. The wise will profit, others will go down the tube. Export or perish, should be his blunt answer to MoF and Industry. Don’t curb any other import except Gold, that too strictly through punitive duties with a built in 12 month sunset clause. Make the sunset clause credible & builtin so that smugglers don’t invest in beating the system.

DAX:

I have bad news for DAX bulls. The index closed the week at 8338.31, well below the highest point hit during the week. Far more importantly, the index failed to rise to 8542.92, the high of the last rally. That means the index tips into a correction starting next week with a target of 7650.

We now have to wait and see far down the index will correct. If this move takes the ensuing move takes the index below 7650, we are into the much anticipated intermediate correction already.

There is a small probability of the index pulling a surprise and making a dash for 8550. Use to exit if not done already. The dash will not change anything much. We are headed for the 7650 area in any case.

Shanghai Composite:

Shanghai Composite closed the week at 2052.24 below it 50 DMA. That was a huge surprise because the minimum one would expect from such a battered down index at this late stage in the bear market is to at least spike up to its 200 DMA 2170 price area. It could still do that but it is probably too late for that.

What the failure to to rally to 200 DMA implies is that Shanghai too would follow the world indices into another correction which will probably test the low 1850. That then could be the trigger for an intermediate counter trend rally within a bear market.

NASDAQ 100 [QQQ]:

QQQ [a traded proxy for NASDAQ 100] 76.49. Nothing on the chart says it will not go on to make a new high during the course of next week. It probably will. But the advances are coming from poor breadth, poor volumes and from suspect sources. For instance, main line technology counters such as IBM are already in decline while stocks such as Apple propel the index via counter-trend rally within a long bear trend. Those are warning signs of an impending correction if not worse.

Note the failure in Shanghai and DAX, two of the major overseas markets have in all probability already slipped into a correction. So be warned. A big move down to 68.90 on QQQ awaits. And that is the minimum target. If the rally from there disappoints or if the market overshoots it, we are headed down for a long while.

S&P 500 [SPY]:

A new high on SPY, albeit not very far from 171, can’t be ruled out. Its value to bulls will be rather symbolic. And then a correction down to 156 or thereabouts should follow. If the market overshoots 156, we have an intermediate correction. If it falls short, the bull market remains intact. There is no way to tell apriori what will be the outcome. Volume, breadth, stocks in the indices, declining number of new highs all point to an intermediate top but time alone will tell.

NSE NIFTY:

NIFTY continued it correction by knifing through one support after the other. Even the long-term trend line support in place sine 2003 was taken out and that has major implications for the NIFTY.

The above is a weekly chart of the NIFTY to put the current correction in perspective. If my wave counts are true, [these are counts that have worked well so far] we are into the last stages of a correction for stocks that peaked in November 2010 [ not January 2008] and these stocks comprise such things as private & public sector banks, finance companies, consumer staples, technology etc that make up some 50 to 60% of the NIFTY’s market capitalization. The chart makes it clear we are in the initial stages of a giant C wave [this is a weekly chart] whose target would well be to retest 4800. That’s huge bear move ahead.

Note the move is coordinated not only with Emerging Markets but also the world’s leading equity markets. So the compression in PEs will compound the problems from a fall in value caused by declining profits. Worse, both will happen in the context of a tightening money markets world wide amidst an interest rate cycle that is turning up. Not to mention a general election that for once is questioning fundamental assumptions. I doubt if India has seen such a correction in its history before.

Be warned.

NB: These notes are just personal musings on the world market trends as a sort of reminder to me on what I thought of them at a particular point in time. They are not predictions and none should rely on them for any investment decisions.

MARKET NOTES: The US Dollar could surprise with a massive rally.

MARKET NOTES: The US Dollar could surprise with a massive rally.

Commodity markets having been marking time waiting for the equity markets to complete their rallies before they make up their minds. The currency markets are clearly anticipating a market sell off in equities that sends Dollars racing back to the safe harbor of US Treasuries. If the scenario comes about, a huge robust Dollar rally will force every other markets to find its new level in relation to it. That also means commodity markets will finally show us their final support. Those sitting on cash will have ample opportunity to stock on the best goodies. So don’t be afraid of cash no matter what pundits tell you about negative real interest rates.

A surging Dollar will put extraordinary pressure on RBI and the INR. RBI may be prepared to battle on till DXY gets to 85 but I suspect the true target is 89. Not sure what RBI’s reaction to $-INR at 70 will be. RBI had ample warnings of the fiscal & CAD deterioration. It had also ample warning about INR being over-valued. Instead of actively making markets & guiding them higher or lower to effect smooth change it slept and then woke up in a panic. RBI must understand markets are always made, they do not just happen. If RBI will not do it some other foreign bank cartel will. The only difference is that the cartel works for its own profit and RBI loses control over the market. So please learn to make markets; and money. The days of central banking by administrative fiat are over. Dead. Gone.

NIFTY is delicately poised on the neckline of a large inverted S-H-S with a target of 5000 from the neckline of 5600. That’s the good news. The bad news is that there is no rule which says the fall will stop at the target. All it says is a bounce then results. There could a short bounce before the neckline is breached to the 200 DMA area. But in all other respects NIFTY has decided not to wait for world markets to tank.

Hoard cash. There will be plenty of time & opportunity at far lower level than these.

Gold:

Gold turned down from the overhead resistance at $1350 and closed the week $1310.50. Gold hasn’t retested its new support at $1170. Furthermore, wave counts favor a retest of the 1150 price zone before a tradable rally ensues. My sense is that, barring minor pull-backs from time to time, Gold will drift towards $1150 by the middle of September.

That should give RBI some breathing time in managing gold flows into India.

Silver:

Silver pulled back on Friday from a low of $19.185 to close the week at $19.912. As discussed last week, Silver is yet to find a credible area of support and my sense is that it will hit the $17 area by end of August. I don’t think that would be the end of Silver’s bear market though we may get a rally of sorts from that area.

HG Copper:

As expected Copper continued to consolidate within a trading range above its recent low of 2.98 and the overhead resistance at 3.20. There may be a change of bias over the next few weeks from up to down but expect Copper to tread in the same trading range for some time more.

Brent:

Switching over from tracking WTI to Brent from this week. Of the two, Brent provides a clearer picture of the international price movements without getting overwhelmed by temporary pipeline logistics in the US domestic market.

The basic wave counts haven’t changed because of the switchover though quite a few the “anomalies” in prices have got ironed out. Brent, as WTI Crude, is in counter-trend rally from the low formed in June 2012 and that cycle appears to be coming to an end in August. The extent of the next leg down will tell us if the correction in crude prices is over or there is some more consolidation ahead.

Brent could shoot for $120 over the first two weeks of August before turning down for a correction. The structure & extent of the next correction will tell us where Brent is headed over the medium term. Exit at rallies.

US Dollar [DXY]:

DXY closed the week 81.978 after bouncing off its 200 DMA at 81.59. The correction in the DXY from the top of 85 is almost over barring a retest of 81.50 before the next rally back to the 85 region and possibly beyond that.

This blog being all about technicals, I won’t venture into discussing the expected correction in equities, the consequent sell off and search for yields in the US bond markets. But one thing is clear. A positive real yield in bonds, backed by some GDP growth, is available only in the US and that’s gonna make inflows in Dollar assets a given.

A resurgent Dollar will rip thru commodity markets, and equities of course. Nothing will be left untouched. So the question is will the rally extend beyond 85? My sense is yes given the extent of correction we saw in wave 4 that is just ending. Humongous volatility ahead.

EURUSD:

The EURUSD rally from the recent bottom of 1.27540 was completed at 1.3300 and we may be headed back to retest of 1.27 by end of September.

The pair closed the week 1.32810. The decent to 1.27 will be paced by the DXY and the extent of sell off that we see in Europe. Likely to be a very volatile trip down with vicious counter-trend rallies.

USDJPY:

USDJPY closed the week at 98.93. Having made a low of 97.67 the pair is now headed up with a first target of 101.50 followed by another overhead resistance of 103.65. My sense is the pair will follow DXY up over the next two months.

USDINR:

The $-INR corrected down from the top of 61.21 as expected towards the INR 59 area making a low of 58.68 during the week. The pair’s 50 DMA is at 58.65. Bouncing of the 50 DMA the pair was back to 61 in double quick time closing the week at 61.09.

We could have another leg of a correction down to 59 area from 61 over the next few days but the major trend remains up and a target of 62.50 looks close at hand.

$-INR cannot remain immune to the strengthening the overseas Dollar where I expect the DXY to rally from 81 to 85 [an up move of 5%]. That makes for a $-INR of 64 just [based on a buy in Singapore & sell in Mumbai model.] Of course reality is much more complex and some of the move from 81 to 85 is already in the price. Even so expect an correction to be short & fleeting while the $ trends up to test new highs.

RBI’s real problems will begin if the US equity markets tip into a deeper correction than 10% and the DXY shoots beyond 85 to 87 or even 89. The 87-89 is not ruled out. If you remember I had set my target for DXY for this full rally from 72 ay 89. And that appears well within reach.

RBI’s trading restrictions may help it manage the politics but the consequences for its credibility as a Central Banker are not worth contemplating. RBI was sleeping at the helm.

German DAX:

No surprises from the index. It is proceeding in a very orderly fashion towards its target of 8545 which it should hit by Friday, next week. The probability of a substantially higher high than 8550 is rather slim though always there. But it is unlikely to be so high that it rules out an intermediate correction as explained before. Execute exit plans and wait for the next correction to unfold & set direction.

NIKKEI 225:

Nikkei bounced up from its 50 DMA in the 13500 area and closed the week at 14466.16. The bounce is unlikely to last though it could stretch upwards 15500 as Nikkei plays catch up to the rally in US markets for the next week.

To my mind, Nikkei remains in a downtrend from the top of 16000 and the downside target, in tandem with other world markets, could be well below 11500. So the next rally in Nikkei is best watched from the sidelines.

NASDAQ thru QQQ:

QQQ [Techs in Nasdaq] pulled no surprises and proceeded in a an orderly fashion to to the target zone of $78. The uptrend has another week or 10 days to exhaust itself. The possibility of an overshoot beyond $78 exists but many key technology stocks are already into an intermediate correction following below expectation results. So yes, we could overshoot but not by much.

And if QQQ just meets target or marginally higher the probability of the following correction being deep enough to tip the market into an intermediate correction is very high. Exit and move to the sidelines. Avoid shorts till we are close to 16th August or we clearly have a top in place.

S&P 500 or SPY:

Like QQQ, SPY showed no surprises moving towards its target in an orderly fashion. Price versus volume divergences on both QQQ and SPY are pronounced but something you would expect at an impending top. SPY has a target of 175. It closed the week at 170.95. Clearly a long way to go with about 2 weeks to get there. The index is not even very overbought at this point.

Could SPY at $175 or better obviate the need for a longer term intermediate correction? It is a close call. SPY tanked from a high of 165.55 in the last correction to a low of 156 or 9.55 points. On the other hand, it has added only 4 points to the top of the previous rally and could add another 5 before it pauses for a correction. So we have 9 down – 9 up. Too close to call at this point.

Shorts not advised at this point but overall exist all long positions before 16th of August and wait patiently for a correction to sort out the market direction.

NSE NIFTY:

NIFTY was the real surprise of the week. First, it failed to make for the top of its trading range at 6240, stopping well short of it at 6065. Next on the way down, it took out both its 50 and 200 DMAs without a pause. Lastly the 3 recent tops at 6075, 6200 and 6075 look like inverted S-H-S with a neckline 5650. The Index itself closed the week at 5677.90 more or less at the neckline. That’s a pretty unusual run of events and the prognosis can’t be encouraging for bulls.

In the normal course, I would expect a respectable pullback from the neckline at 5650 to the 200 DMA before taking another shy at the neckline. I don’t think the neckline will hold for long and that gives the NIFTY a target of 5000. That would also more or less complete the correction in NIFTY in tandem with the world markets. Of course the process will take time.

NB: These notes are just personal musings on the world market trends as a sort of reminder to me on what I thought of them at a particular point in time. They are not predictions and none should rely on them for any investment decisions.

MARKET NOTES: When The Market Offers You Money For Jam, Take Both and Run!

MARKET NOTES: When The Market Offers You Money For Jam, Take Both and Run!

This post should really be seen as a continuation of the last blogpost. The last one showed the longterm state of the markets in monthly charts and demonstrated how we were nearing an inflection point in the context of longterm trends. I would encourage you to go back and read it for perspective. This post deals with the same impending inflection point – the possible onset of an intermediate correction – from the perspective of the last leg of the rally up in terms of daily charts. The message from both in more or less the same.

Russell 2000, NASDAQ and S&P500, together with EU equity markets such as the DAX, show they are in the last part of this leg of the rally that started in November 2012, a point that marked the end of wave IV for most US markets on the way up from March, 2009. What that means is we will have a correction around Mid-August for sure. The only issue is if it will be like the ones we have seen many times on the the way up here or will it be of a much longer – and deeper – duration in terms of time and distance covered?

The maturity of the bull markets in terms of time, and the wave counts, favor the odds of a longer and deeper intermediate correction. Note that doesn’t mean a crash like the one we had in 2008. In fact the principle of alternation almost guarantees that the next correction will be beguilingly gentle to begin with. The sting and value destruction will be in the tail. What we are likely to see is a gradual deepening of the drops in prices followed by rallies that recover only part of the ground.

The price correction in most commodity markets is more or less over. That doesn’t mean they are now bullish. But many will tank with the correction in equity markets and that might be a good time to accumulate some of them for decent tradable intermediate counter-trend rallies. I have new take on WTI crude that might interest traders. It shows crude peaking out at $115 and then joining the rest of the herd into a correction.

DXY can correct down to 81.25 in the wave IV correction now underway. I reckon we are in the C leg of it. But maintain my longterm view of the dollar heading towards 85.50 or higher by the year end. That has implications for INR in Indian markets.

Time to take profits and move to the sidelines in an euphoria. The Russell 2000 mid-cap space is unbelievable. It has just returned 11% in the last 18 days over and above a similar leg just prior to the last correction. If that’s not euphoria, what is?

Yield on 10 Year Treasury Notes [$TNX]:

As expected, the yields on 10 year Treasury Notes [$TNX] drifted down during the week as panic in the bond markets subsided. They closed the week at 249.10 basis points. Note, this doesn’t alter the fact that the interest rate cycle as turned up decisively. Nor has all of Fed’s talk been able to reverse this fact.

Yields can be expected to drift down towards the 205 basis points mark as the market tests new support for the yields. The drift down simply accepts the new higher normal yields while working off the excesses of the panic.

If, as expected in this blog, the equity markets do begin an intermediate correction in mid-August, we could see a lot money returning to US Treasuries, further depressing yields. So the panic in bond markets is definitely done & over.

Gold:

Gold closed the week at $1292.90 after having made a bottom at $1223.70. I would not think we have found a longterm bottom in gold as yet. There may be further declines to come in the months ahead. But for now we have a temporary bottom at 1223.70 and gold appears to be rallying to establish some sort of an upper range within which to consolidate in the weeks ahead.

Gold could rally to 1350 or so till the middle of August in line with other risk assets. The metal could then correct to retest $1223.70 before attempting further counter-trend rallies.

Gold’s 50 DMA lies at $1350 and it could act as the first major overhead resistance. Not bullish on the metal despite the counter-trend rally underway. The metal could correct sharply as other risk assets fall in the ensuing across-the-board correction that I anticipate mid-August.

Silver:

Silver closed the week at $19.46 after having made a high of $20.25 since the bottom at $18.17. I remain very skeptical about the metal. My wave counts indicate that the metal could seek lower lows after mid-August. The metal has no notable price support before $14 on the downside. These aren’t levels to play the short side. But until Silver finds a confirmed bottom avoid trading in the metal; long or short.

HG Copper:

HG Copper went into a small counter-trend rally after finding a temporary bottom at 2.9835 on 25th June. The metal closed at 3.14, just under its 50 DMA, which is at 3.21. Copper’s counter-trend rally is unlikely to go beyond 3.21 for now.

Copper will correct with the rest of the markets. But there isn’t much downside to the metal below 3.0 and the metal could see a ferocious bear squeeze over the next few months if not weeks. Again, the metal is at the fag end of a very long correction and unless you are a compulsive trader, it is best avoided for its unpredictable volatility.

Not yet time to accumulate for the longterm.

WTI Crude:

WTI Crude’s counter-trend rally has been baffling to many in many ways. The best way to get your arms around the big technical picture is shown in the above chart.

Crude made a top at $107.43 in April 2011 and then corrected to $79.76 in June 2012. The rally from June 2012 now underway can take Crude to as high as $115. See together with rally in crude from the low of $40.24 in January 2009, you get a picture perfect 5 wave impulse rally that terminates mid-August around $115.

Must admit it took me a long long time to figure out this one. But it neatly accounts for the twists and turns in the crude prices that we have seen since 2009. If my analysis confirms a top of $115 in mid-August, we have fairly long correction in crude prices ahead of us.

US Dollar [DXY]:

The Dollar has been correcting from its recent top at 84.9250 made on 9th July. The correction, a 3-part A-B-C, Wave 4 could take DXY down to as much as 81.25. We are in the C part of the wave. The Dollar is likely to resume its uptrend on a successful test of 81.25.

The low on DXY corresponds to the expected high on the equity markets around mid-August. Coincidence? If so, very convenient :p

Maintain my longterm bullish view on the DXY with at target of 85.50 before the end of this year.

EURUSD:

EURUSD has completed its complex correction from the top of 1.37 with the close at 1.2780 on 9th July. With that the currency pair resumes its counter-trend rally underway from the low of 1.2050 formed in August 2012.

EURUSD closed the week at 1.3142, well above both its 200 and 50 DMAs both of which are fairly close together 1.31 though they haven’t generated a longterm buy signal as yet.

EURUSD’s first major overhead resistance lies at 1.34 while the 200 DMA will be its first support for sometime. Mind this is a counter-trend rally and so subject to a very high degree of jaggedness and volatility.

USDJPY:

USDJPY has been in a counter-trend rally from the low of 94 made on 14th June. The rally appears to have topped out 101.17. The pair is now into wave C of the correction from the recent top of 103.65 with a target of 94.

That said, has the counter-trend rally ended at 101.56 as the chart shows? Not quite. There is room on the charts for the counter-trend rally to extend all the way to 103.50. On the other hand, as a read of DXY indicates, the extension is possible but improbable.

The EURUSD may be the better way to play DXY for the immediate future till USD has definitely topped out in the Yen market.

USDINR:

The Dollar appears to be consolidating just above the INR 59 mark on the charts. This consolidation is likely to continue well into September before the Dollar makes any major move either way.

The Dollar’s first support in the consolidation lies at INR 57.30 followed by another major support at INR 56. As DXY heads lower to 81.25 from its current level at 82.71 over the next few weeks, expect it move lower in the INR market to test both these support levels.

The panic in the INR market should now be over. Note the fall in DXY is not yet fully into the USDINR price at the moment because of the panic buying.

That said, maintain my bullish view on DXY and USDINR. We may end the year with USDINR closer to INR 63.50 levels rather than INR 56.

NIKKEI 225:

Nikkei 225 closed the week with a key reversal day at 14,589.91. The index is in a counter-trend rally from the low of 12,435.95 with a target of 16000 or thereabouts. Nikkei has many a key reversal day and the rally just continues as if nothing has happened. So it is no more than a cautionary flag at this point.

My sense is that Nikkei will at least make a higher top than the one at 15,962.89 in this counter-trend rally. The wave counts for Nikkei that I favor show the rally from the low of 6840 in October 2009 as the Wave I of a new bull market, which though poorly structured, hasn’t yet quite finished its job and has much distance and time to go. The leg down from 15,962 was “A” part of the correction and we are in “B” up. It is usual for B waves in Wave I to exceed the leg down in distance. For Nikkei to confirm that pattern would be a very powerful bullish signal. Maintain my bullish stance on Nikkei for a new top. The correction from there will likely coincide with the mid-August D-day.

Shanghai Comp:

Shanghai made a recent low of 1851 and rallied smartly from there to make a high of 2093, just under it 50 and 200 DMAs. The index closed the week at 1992.65 and is in the process of correcting for the last rally.

My sense is SSEC could drift down to 1900 early next week and that would be a good buying opportunity if it comes by. That said, Shanghai is likely to turn up from 1900 or perhaps even earlier to rally for at least its 200 DMA which is currently in the 2200 region.

The peak is indicated at the middle of August. The index could well correct from there along with rest of the world markets.

German DAX:

There are only two issues in all the charts that follow. Firstly, will there be a new high? And secondly, will the new high be high enough so that the correction that follows won’t tip the index into an intermediate correction.

First there is space for a new high. There is nothing on the charts, not even over-bought conditions, to show that there won’t be one. Will it be high enough? My sense is DAX would have to overshoot its indicated target by a good 5 to 8% for it to avoid a follow-on intermediate correction. The wave-counts say it is good place to trigger an intermediate correction. The rest really depends on the exact technical state of the market.

The correction that follows will be deceptive and back-ended, & not a crash.

Russell 2000 [RUT]:

RUT is arguably the most aggressively bullish index in the US and that by itself should be a cause for concern! It is the buying frenzy in mid-cap stocks by retail investors that sets up markets for deep corrections. Plenty of evidence that a buy frenzy is actually underway.

RUT closed the week at 1050.48. From the last low of 943.41, Russell is already up by 107.07 points or 11.3% in a little over 18 days. This is on the top of another similar parabolic run from 898 to 1010 about a month back. How much can the herd digest?

RUT has already made a new high. There is room for some more euphoric rise. It would be foolhardy not to take profits and run. Such euphoric conditions signify serious longterm distribution to the gullible & greedy.

Nasdaq 100 or $QQQ:

Instead of the NASDAQ 100, I have used its equivalent $QQQ ETF that has the advantage of an explicit volume to go with the price and is often more revealing than the Index itself.

$QQQ has rallied sharply from its low of 68.99 to a high of 75.50 before closing the week at 74.59 following appalling results from MSFT and GOOG. The index has major support just atop the gap at 74 that it had better not fill. In fact, that might be a good way to trigger your stop losses and exit the market.

The index is likely to test its support at 74 before continuing into the rally. As I indicated last week, the rally has run out of telomeres. You could have an extension if Index pulls a spectacular 5 to 8% rally from current levels. But the probability is dim & the odds are that the next correction will gently tip the markets into an intermediate term correction spanning many months.

S&P 500 using SPY:

SPY is just a traded ETF version of the SPX. The advantage of using it instead of the Index is a good handle on volume versus price equation.

SPY has already made a new high. The question now is about the correction to follow. Will it be a modest one shot affair spanning a few weeks or a month or two to be followed by a resumption of the bull market or will it be one spanning a year or more?

SPY is barely 1.50 points higher than the top of the previous rally that triggered a correction. Namely it has made a high of 75.50 against the previous top of 74. That is not much. What the numbers signify is diminishing strength in momentum. SPY has scope to go higher. But it would be wise to take profits.

Volumes in both QQQ and SPY have been higher on days the market declined. There are divergences on the RSI charts as well. All said, odds favor the onset of a fairly prolonged correction at the end of this leg of the rally. D-Day could be any day after 14th August though my charts suggest 19th for SPY.

NSE NIFTY:

NIFTY closed the week at 6029.20 after rallying from its recent low of 5590, also its 200 DMA. The rally towards the previous top of 6250 is reactive in nature. Emerging markets have been correcting savagely for some months now and may not take a severe hit as the world markets tip into an intermediate correction. But it would be unwise to rule out turbulence.

My sense is NIFTY will almost certainly hit a higher high than 6250 in this rally. It is the correction that follows which will be crucial. I would take profits at the projected high and then see how the correction that follows shapes up.

It is hard to see a meaningful & sustainable rally in the NIFTY before a new government steps in. And as the longterm charts in the previous blogpost show, there is room for a downturn in NIFTY that takes to test 5400 or even lower by the end of 2013.

Wise to take profits.

NB: These notes are just personal musings on the world market trends as a sort of reminder to me on what I thought of them at a particular point in time. They are not predictions and none should rely on them for any investment decisions.

MARKET NOTES: As the markets hit new highs, look to take profits.

MARKET NOTES: As the markets hit new highs, look to take profits.

NB: These notes are just personal musings on the world market trends as a sort of reminder to me on what I thought of them at a particular point in time. They are not predictions and none should rely on them for any investment decisions.

This blog had ventured to suggest that the last correction may not be the beginning of a intermediate correction and that we will have a subsequent shy at new tops. That scenario appears to be working out. Nasdaq 100 has already made a new high, SPX is pretty close to one, and others such as Nikkei, Shanghai and NIFTY are not far behind. But this blog had also suggested this rally may be the last before a substantial correction. Maintain that view unless the new highs are 5 to 6% higher than previous tops. So keep exit plans handy. D day could be 2nd week of August.

There is a rather lengthy note on the $-INR in the blog. Have always argued our whole foreign trade and foreign exchange management is riddled with flawed assumptions, not so much for lack of knowledge and understanding, but rather to protect vested interests. Cotton exports against lower cotton prices for local manufacturers is the sort of problem at one end of the spectrum. The failure to see value-addition as the key variable of domestic prosperity rather than the absolute export numbers is the other. Take cotton. What are we exporting? Sunshine, water, labor and some fertilizer & pesticide. What do spinners add to cotton by spinning it into yarn? Barely 10% at enormous cost. But if you take the distribution of profits between growers and spinners, the lion’s share goes to spinners. Such is the perversity of our economy. Forex has been the key fulcrum on which the edifice to transfer wealth from farmers to industry was built under the socialist raj. The apparatus is still largely intact. Most economist know of it. Nobody talks of it.

No change in the prognosis on NIFTY. Use the counter trend rally to exit.

Happy trading.

Yield on 10 year Treasury Notes:

http://stockcharts.com/h-sc/ui?s=$TNX&p=W&b=5&g=0&id=p16570754730&a=308769391

The yield on 10 year treasury notes continued at elevated levels but moderated a bit, closing the week at 259 basis points after having made a high of 274. On the long term weekly charts, 280 basis points appears to be a good place to pause from some consolidation before the uptrend resumes. The climb in yields has been pretty steep

since May. We could have a few weeks of consolidation with yields dropping back to around 200 bps as the correction sets in.

Gold:

http://stockcharts.com/h-sc/ui?s=$GOLD&p=M&b=5&g=0&id=p91093061335&a=308778277

Gold continues to surprise to the downside. It closed the week at $1277.60 after rallying from a new low of 1212.10. The monthly chart of gold prices above shows that while $1160 was a support area, Gold is more likely to test the $950 area before it finds some solid support from long term, long only investors. The wave counts, the support line for the long term uptrend support line and the fractal being traced out by gold prices all point to further weakness in gold prices. There is plenty of time for gold prices to drift down as well. Indians would be wise to leave the metal alone for some time but then I have been warning of a bear market in gold for the past 2 years and more. Don’t see a significant rally in gold prices until after March 2014.

Silver:

http://stockcharts.com/h-sc/ui?s=$SILVER&p=M&b=5&g=0&id=p94549700653&a=308782266

Silver’s first major support zone was $20 made a low of $18.17 before staging a minor rally to $20.25, closing the week at $19.792. The above monthly charts shows the next major support for Silver is at $14 and it has plenty of time to get there. I don’t think the metal will find any significant rallies from here until it test $14 although it can hang around current levels for a while.

HG Copper:

http://stockcharts.com/h-sc/ui?s=$COPPER&p=M&b=5&g=0&id=p58042402073&a=308783851

Copper has been rather reluctant to test levels below 3.0 and has bounced from the region on several occasions in the past. My sense is that while Copper has more or less finished its price correction, it could mark time in the 2.80 to 3.40 price region before staging a significant rally. Definitely not a metal to short at these prices.

WTI Crude:

http://stockcharts.com/h-sc/ui?s=$WTIC&p=M&b=5&g=0&id=p58042402073&a=308784188

WTI Crude’s price has been trending up on thinner and thinner volumes for the past 2 years! That fact alone should make one very wary of WTI Crude’s chart. The second fact that put’s crude long term chart out of kilter is the fact that it peaked in 2007, long before the rest of the commodities did so. In my view that is significant price “failure” in on the long term charts and crude’s rather anomalous price behavior points to the same fault line. There is no doubt in mind that the technicals point to a price of WTI crude in the $80 region in the intermediate term ahead.

That said crude has been in a counter-trend rally from a price of $84 since the June of 2012 and that bear rally could have peaked out $107.426. My sense is that elevated crude prices reflect some sort of a technical bear squeeze that cannot persist for long. However, keep in mind crude’s tendency to shoot for the highs at the slightest provocation. My sense is crude will return to test $80 levels before long. But avoid shorts.

Reuters CRB Index:

http://stockcharts.com/h-sc/ui?s=$CRB&p=M&b=5&g=0&id=p58042402073&a=308785978

The CRB Index puts the triangulation underway in commodities into global perspective. The index itself has little predictive value but it does confirm the notion that triangulation in the open auction markets is perhaps the only way to true price discovery. Note the 250 support line for the index. With the index poised at 270, we are not far from support. My sense is agricultural commodities will recover way ahead of the industrials & precious metals. But that’s a subject for another day. Long term bears will be looking to exit shorts in most commodities.

US Dollar Index [DXY]:

http://stockcharts.com/h-sc/ui?s=$USD&p=M&b=5&g=0&id=p58042402073&a=308786829

This week’s blog is all about underlying long term trends since markets appear to be approaching an inflection point. Who looks at monthly currency charts in markets? Well I do and its very instructive to place things in perspective. First note that DXY bottomed in 2008 and then confirmed that bottom in 2011. Its been in an uptrend since then and those surprised by my bullishness on the $ for the past 2 years contrary to all conventional wisdom now know why. That uptrend is about to end. If it ends now, or after another 6 months is the moot question.

Note DXY has broken out of a fairly large and significant triangle and has since confirmed the breakout to the upside. That’s the basic reason why I have been suggesting a target of 85.50 for the DXY. The index can overshoot that target to test 89 before an intermediate correction sets in. So 2 things stand out. Firstly, the long bull run in the DXY is now approaching its final run up. So things will be volatile. And secondly, wave Vs can be terrible in what the do to price extension. We are in wave 3 of Wave V from the bottom of 72.50 in 2011 by my count. Fasten seat belts.

EURUSD:

EURUSD staged a smart counter-trend rally from the 1.27 price region to 1.32 before closing the week at 1.3066 sandwiched between its 200 and 50 DMAs. The rally from 1.27 upwards was reactive and the correction underway from 1.37 in February is far from over.

My sense is EURUSD will return to test 1.27 over the next 4 weeks before turning up. I don’t think we will see EURUSD below 1.27 in this correction.

USDJPY: